Wireless audio speaker maker Sonos (NASDAQ:SONO) has been looking forward to the release of a new product, which has the potential to boost sales considerably. The stock presents a relative value proposition that may change as market sentiment swings further towards positivity (assuming a successful launch). The opportunity might be suitable for value investors looking to make sweet music.

New Headphones May Drive Growth

Sonos develops and distributes multi-room wireless smart home sound systems designed to support streaming services. It also produces various products and services, including wireless, portable, and home theater speakers, along with components and accessories.

While the company saw a healthy jump in sales during COVID-19, those sales have stagnated over the past few years. To help turn things around, the company is targeting moving into new categories. It is currently working on bringing new, wireless over-ear headphones to market that will integrate with its system.

The company aims to produce between 650,000 and 1 million units in the upcoming year to meet expected demand. CEO Patrick Spence is banking on the new headphones to spur growth within the company, a strategy that will directly pit Sonos against big competitors such as Apple (NASDAQ:AAPL), Sony (NYSE:SONY), and Bose.

Recent Results & Future Outlook

Sonos announced its Q1 FY2024 results last month, surpassing expectations. Although revenue declined by 8.9% YoY to $612.9 million, it exceeded the Street’s estimate of $587.2 million. Adjusted EPS for the quarter was $0.84, significantly higher than the anticipated $0.58 and up from 79 cents a year ago. Moreover, the company generated a net income of $80.9 million, a 7.7% increase from Q1 2023, while the profit margin also rose to 13%, up from 11% the previous year.

The company expects revenue for the full financial year to hover around the $1.65 billion mark, which aligns with analysts’ estimates.

Where the Stock Stands Now

The stock had been on a long three-year descent, though it has rebounded 34.69% in the past six months. The recent price is trading towards the upper middle of its 52-week range of $9.78-$21.98. The positive shift in price momentum has the shares trading above the 20-day (18.65) and 50-day (17.75) moving averages.

Despite the recent price increase, the stock appears relatively undervalued based on comparative metrics. The P/S of 1.5x sits well below the averages of the Technology sector (4.6x) and the Consumer Electronics industry (3.7x).

Positive price momentum with relative value could make for a compelling mix if the company successfully executes its multi-year product strategy, beginning with the new headphones. A strong launch could further catalyze the stock price to rise, making the current price level a reasonable entry point for value investors.

Is SONO a Buy, Hold, or Sell?

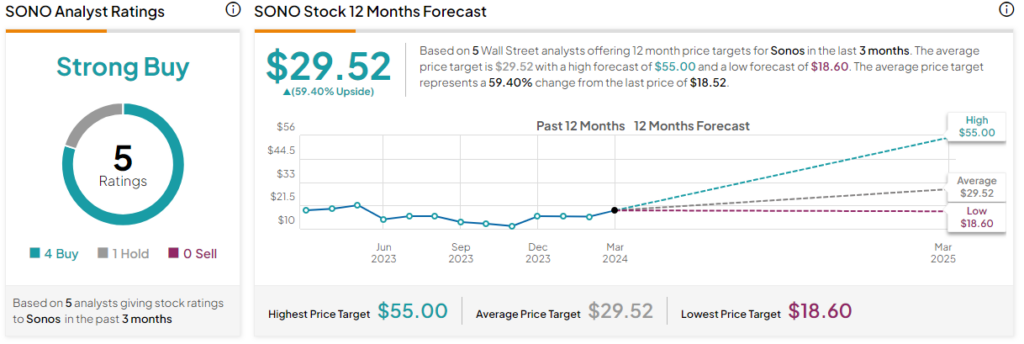

Analysts covering the stock have been bullish. For instance, Jefferies analyst Brent Thill recently increased the stock price target to $25 from $22 while reiterating a Buy rating, citing the expected earnings boost from the new product line.

Based on five analysts’ stock ratings in the past three months, Sonos is listed as a Strong Buy. The average SONO price target of $29.52 represents an upside potential of 60.09% from current levels.

Closing Thoughts on SONO

As Sonos expands its product portfolio and ventures into the headphone category, the financial implications could be notable, given the potential for substantial revenue uplift. As we move closer to the launch, all eyes will be on the impact of this new category on Sonos’s bottom line. The stock appears to be relatively undervalued, though that window could close as market participants gain greater enthusiasm for the company’s positive momentum.

However, there is a substantial risk of price volatility, especially on the downside, if the company misses the delivery window or the product isn’t well received. Value investors will want to keep an ear out for Sonos’ moves in the coming months.