Sonos Inc. (NASDAQ:SONO) stock declined more than 2% yesterday after losing a patent dispute against Alphabet’s (NASDAQ:GOOGL) Google. Judge William Alsup of the Northern District of California ruled that two of Sonos’ patents are not enforceable.

Sonos is an audio technology company known for its high-quality wireless speakers and smart audio products.

The judge said that Sonos initially filed provisional applications for both patents related to multi-room audio technology in 2006. However, the company delayed completing its application for about 13 years. Also, he said that Sonos had wrongly tried to connect its patents to the 2006 application to prove that its innovations existed before those of Google’s devices.

The recent ruling nullifies the verdict from a federal jury in San Francisco in May, which had awarded Sonos $32.5 million in damages from Google.

SONO-GOOGL’s Brief History

SONO and GOOGL had initially collaborated to integrate Google’s streaming music service into Sonos’ products. The dispute between the companies started in 2020 when Sonos accused Google of infringing upon four patents by using Sonos’ technology in wireless audio devices, including Google Home and Chromecast Audio.

At the same time, Google sued Sonos for using a significant amount of GOOGL’s technology without authorization in various products, such as controller apps and its Sonos Radio service.

Is SONO a Good Stock to Buy?

Sonos’ superior product quality and focus on innovation are expected to help the company continue to attract customers. Moreover, the surging demand for home audio products due to the growth of online streaming will likely support Sonos’ topline.

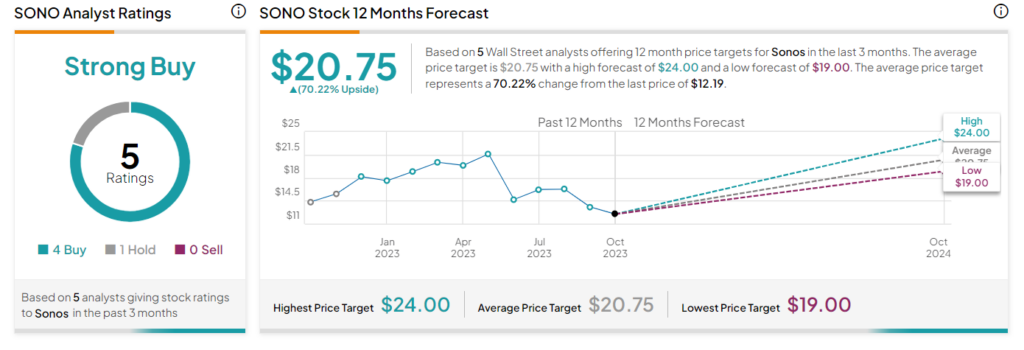

Overall, Sonos stock has a Strong Buy consensus rating based on four Buys and one Hold. The average price target of $20.75 implies 70.2% upside potential. The stock is down more than 27% so far in 2023.