SoFi Technologies (SOFI) is scheduled to announce its results for the third quarter of 2025 next week on October 28. SOFI stock has rallied about 82% year-to-date, fueled by strong financial results and a fast-growing customer base. The company continues to expand its member network and deepen customer engagement through steady growth in its product offerings. While several analysts acknowledge SoFi’s strong fundamentals, they are cautious about the stock, as they believe the positives are already priced in.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

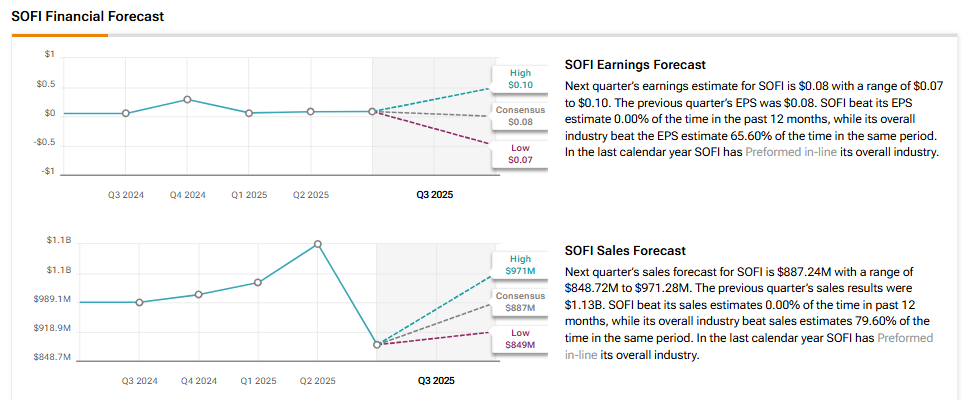

Wall Street expects SOFI’s Q3 revenue to decrease by more than 10% to about $887.2 million, while earnings per share (EPS) is estimated to jump to $0.08 from $0.05 in the prior-year quarter.

Analysts’ Views Ahead of SOFI’s Q3 Earnings

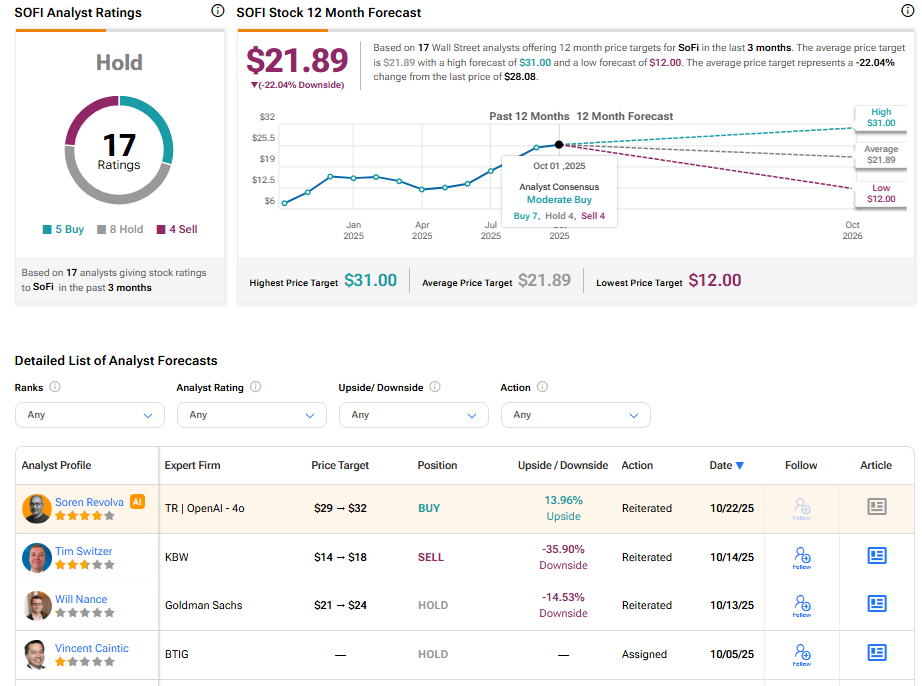

Heading into Q3 results, Keefe, Bruyette & Woods (KBW) analyst Tim Switzer raised his price target to $18 from $14, while reaffirming his Sell rating on the stock. The analyst increased his earnings estimates slightly, keeping his 2025 EPS forecast at $0.32 but lifting his 2025 EBITDA estimate to $998 million from $983 million — higher than both management’s guidance of $960 million and the Street’s consensus. He also raised his 2026 EPS estimate to $0.55 from $0.48, which sits at the low end of management’s $0.55–$0.80 range and is roughly in line with consensus expectations of $0.56.

While Switzer sees the possibility of many favorable potential catalysts supporting SOFI shares over the near term, he remains bearish as he believes that the stock’s risk/reward “seems skewed negatively over the long term given the premium valuation.”

Meanwhile, Mizuho analyst Dan Dolev raised his price target on SoFi to $31 from $26 while maintaining a Buy rating. Dolev noted that bank processors, consumer lenders, and exchanges stand to benefit the most from potential interest rate cuts. He added that SoFi’s strong rate-sensitive outlook supports a higher valuation compared to peers.

AI Analyst Is Bullish on SOFI Stock Ahead of Q3 Print

Interestingly, TipRanks’ AI stock analyst has assigned an Outperform rating to SOFI stock with a price target of $32, indicating 17.69% upside potential. According to TipRanks’ AI analysis, SoFi Technologies’ strong financial performance and bullish technical indicators are slightly offset by valuation concerns.

Here’s What Options Traders Anticipate Ahead of SOFI’s Q3 Earnings

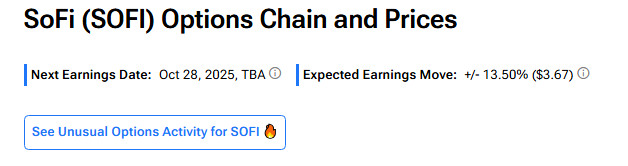

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 13.50% move in either direction in SoFi Technologies stock in reaction to Q3 results.

Is SOFI a Good Stock to Buy?

Overall, Wall Street is sidelined on SoFi Technologies stock with a Hold consensus rating based on five Buys, eight Holds, and four Sell recommendations. The average SOFI stock price target of $21.89 indicates a possible downside of 22.04% from current levels.