SoFi Technologies (NASDAQ:SOFI) stock has gained about 33% over the past year with support from its growing deposit base and efforts to diversify its business. The company has been witnessing encouraging website traffic trends for 2024 so far. This indicates that SoFi’s strategic efforts to change its business model away from lending will continue to lead to strong performance in the near future. Moreover, Wall Street analysts see over 25% upside potential in SOFI stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SoFi is a financial technology company that offers student loan refinancing, personal loans, mortgages, and investment services.

SOFI’s Website Traffic Points to Substantial Growth

Investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame. (Learn how Website Traffic can help you research your favorite stocks.)

According to the tool, total year-to-date visits to sofi.com surged by an impressive 172.45% from the same period last year.

It should be noted that SoFI delivered an exceptional performance in the first quarter of 2024. It reported revenues of $580.648 million, up 26% year-over-year and above the analysts’ expectations of $555 million. Furthermore, the company’s membership base during the quarter increased by 44% on a year-over-year basis.

Is it Good to Invest in SoFi?

SOFI is making all the efforts to turn around its performance. This includes introducing new products and diversifying its revenue sources. Moreover, the company is attracting large customer deposits, which should help lower the cost of funding loans and thereby its bottom line. These factors, along with SOFI’s strong financial performance, may support its share price to grow.

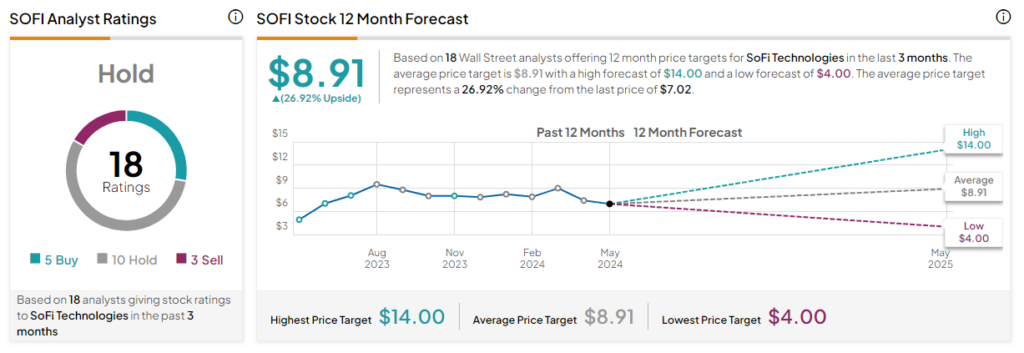

Wall Street analysts also expect the company’s stock to move higher. Analysts’ average price target on SoFi stock of $8.91 implies 26.92% upside potential in the next 12 months. Meanwhile, the stock has a Hold consensus rating with five Buy, 10 Hold, and three Sell recommendations.