SoFi Technologies (NASDAQ:SOFI) is in a transition phase, and the company doesn’t mainly want to be a lending business anymore. This makes sense, but short-term stock traders can have terribly short attention spans sometimes. Therefore, since SoFi Technologies seeks to evolve its business model and should benefit from this change, I am bullish long-term on SOFI stock while the market sells it off.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SoFi Technologies operates a financial services app and technology platform. Moreover, the company is a chartered bank and lender. Until recently, SoFi leaned heavily on its lending business, which included helping people refinance their federal student loans.

The times have changed, though, and SoFi Technologies now has to adapt and adjust. The problem is that the market doesn’t want to wait for anything anymore; stock traders want to see solid results and ultra-optimistic near-term guidance. That’s a lot to ask for a company that’s in a transition phase, so I believe investors should consider being patient with SoFi, both the company and the stock.

SoFi Technologies Beats Earnings Estimates, but Stock Drops Anyway

Is this a confusing earnings season, or what? Tesla (NASDAQ:TSLA) missed analysts’ consensus EPS estimate, and the stock immediately went up 12%. Meta Platforms (NASDAQ:META) delivered an earnings beat, but the stock fell 12%. Intel (NASDAQ:INTC) also beat Wall Street’s EPS forecast, and the stock still tanked. To all of that, we can add SoFi Technologies to the list of counterintuitive post-earnings market reactions.

Here’s the breakdown for SoFi Technologies’ first-quarter 2024 results. First of all, analysts had expected the company to post adjusted net revenue of $555 million. The actual result was $580.648 million, up 26% year-over-year. So far, so good.

Furthermore, SoFi Technologies recorded Q1-2024 adjusted EBITDA of $144.385 million, up 91% year-over-year. By that measure, SoFi is definitely on the path to success in 2024.

Moving away from dollar figures for a moment, SoFi Technologies added nearly 622,000 in 2024’s first quarter, and the company’s total membership surpassed 8.1 million by the quarter’s end. That total membership count is up by nearly 2.5 million, or 44%, on a year-over-year basis.

In addition to all of that, SoFi Technologies reported Q1-2024 earnings of $0.02 per diluted share. That might not sound mind-blowing, but it’s definitely better than the loss of $0.05 per share from the year-earlier quarter. Plus, this result beat Wall Street’s consensus forecast that SoFi would earn just a penny per share.

Unforgiving Market Won’t Wait for SoFi Technologies’ Transition

How can we account for the weird market responses to the quarterly reports of Tesla, Meta Platforms, Intel, SoFi Technologies, and others? In most instances, it has to do with disappointing forward guidance. Along with that, the market just doesn’t want to wait for SoFi to undergo its transitional period.

I’ll let the company explain this. “2024 remains a transitional year for SoFi as the Tech Platform and Financial Services segments together are expected to drive growth and increase from 38% of total adjusted net revenue in 2023 to approximately 50% for the full year of 2024,” SoFi Technologies wrote in a statement. Essentially, as those two segments increase their share of revenue, the Lending segment’s revenue as a percentage will fall.

The economic landscape is changing, so it makes sense for SoFi Technologies to adapt. The current U.S. administration is known for forgiving (i.e., eliminating) federal student loan debt. Besides, elevated interest rates make it difficult for borrowers to repay their loans nowadays.

Consequently, SoFi Technologies is making a smart move by shifting its focus away from its lending business and toward other segments. Since this transition is in progress, there will inevitably be some friction, which will manifest as temporarily soft revenue and profits.

However, short-term stock traders just aren’t in the mood to wait for SoFi Technologies to make these changes. Since the company published relatively soft current-quarter sales guidance, SoFi stock was down 10% on the day of the earnings report.

Analysts had called for SoFi Technologies to generate adjusted net revenue of $581 million in this year’s second quarter. In contrast, SoFi guided for current-quarter adjusted net revenue of $555 million to $565 million. That’s understandable, but this isn’t an understanding market.

Is SOFI Stock a Buy, According to Analysts?

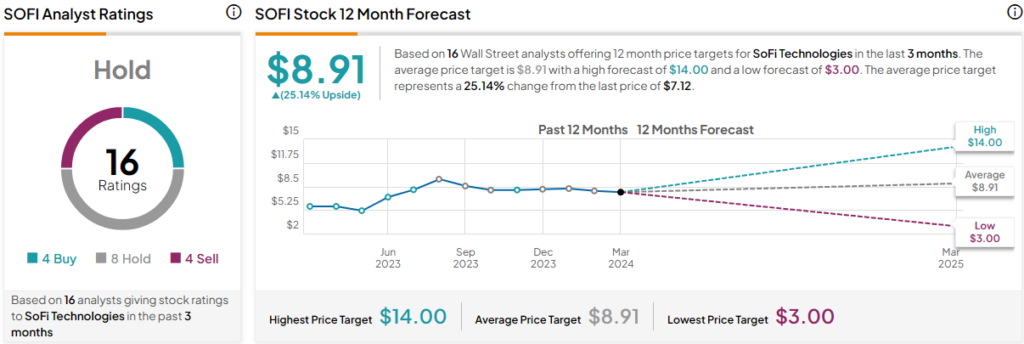

On TipRanks, SOFI comes in as a Hold based on four Buys, eight Holds, and four Sell ratings assigned by analysts in the past three months. The average SoFi Technologies price target is $8.91, implying % upside potential.

Conclusion: Should You Consider SOFI Stock?

Change can scare the market, but it doesn’t have to scare you. SoFi Technologies is changing its business model in response to a shifting economic landscape. This makes sense, but the market’s near-term reactions can be senseless sometimes.

So, after an earnings beat, SoFi Technologies shouldn’t be punished for publishing realistic current-quarter guidance amid a major transition. Hence, I am going into contrarian mode and am definitely considering a share position in SOFI stock.