SoFi Technologies (SOFI) surged nearly 6% on Wednesday, adding to its recent rally, and according to TipRanks’ new AI Stock Analysis tool, the stock may continue to climb. Backed by strong Q1 results, upbeat guidance, and renewed investor interest, SoFi now appears well-positioned for further upside.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

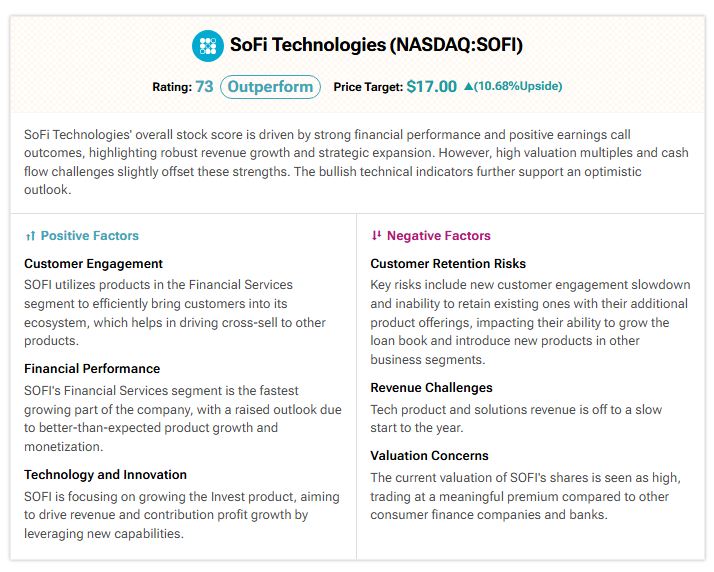

This AI-powered tool uses automated, data-backed evaluations to assess a stock’s outlook across key metrics. In SoFi’s case, TipRanks’ AI-powered stock analysis gives SoFi a score of 73 out of 100, with an “Outperform” rating, and a price target of $17, implying over 10% upside from current levels.

TipRanks AI Highlights Strong Financial Momentum

SoFi has already gained more than 20% over the past three months, supported by solid growth in its Financial Services segment. This area, which includes personal loans, banking, and investment products, remains the company’s fastest-growing business. TipRanks’ AI notes that stronger-than-expected product performance and better monetization are helping drive this momentum.

In addition, the platform highlights SoFi’s success in bringing more customers into its ecosystem. This cross-sell strategy—encouraging users to adopt multiple services—has improved engagement and supports future revenue growth.

Risks Remain

Still, the AI analysis also points to key risks. One concern is customer retention, as engagement trends have started to soften. Meanwhile, slower uptake of new offerings is expected to impact SoFi’s ability to grow its loan book or expand into other segments. Another challenge is SOFI’s steep valuation. The stock currently trades at a premium compared to peers in the financial sector.

Is SOFI Stock a Buy, Hold, or Sell?

To summarize, Wall Street has a Hold consensus rating on SoFi stock based on seven Buys, five Holds, and three Sell recommendations. The average SOFI stock price target of $14.05 implies a limited downside potential of about 8.5% from current levels.