The U.S. Federal Reserve once again kept the benchmark interest rate unchanged. This suggests that interest rates may have peaked, potentially opening the door for future rate cuts. The expected reduction in interest rates is a positive for financial technology companies like SoFi (NASDAQ:SOFI) and Upstart (NASDAQ:UPST), as it will drive lending on their platforms, implying better days are ahead.

Following the Fed’s announcement, UPST and SOFI stocks closed 9.8% and 6.4% higher, respectively, on March 20. Further, both stocks traded in the green in the pre-market session on March 21.

Notably, the prolonged high interest rates sparked worries regarding loan originations and borrower defaults. Further, it posed challenges in securing third-party funding. Given these concerns, SOFI and UPST are down about 26% and 35%, respectively, year-to-date. Nonetheless, the expected rate reductions are poised to somewhat mitigate these concerns and bolster loan demand. With this background, let’s look at the Street’s forecast for SOFI and UPST.

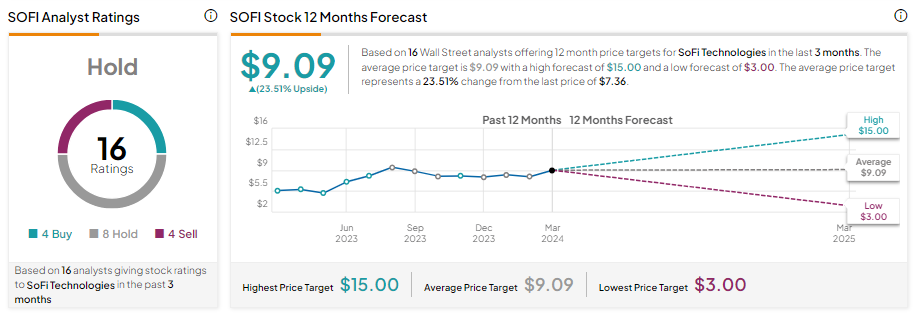

What is the Prediction for SoFi Stock?

SoFi continues to deliver solid financials despite macro challenges led by strength in its personal loans business, solid deposit base, and lower cost of capital. Moreover, the rate cuts will likely act as a catalyst.

However, near-term concerns over lending and fear of equity dilution keep analysts sidelined. SOFI stock has four Buy, eight Hold, and four Sell recommendations for a Hold consensus rating. Analysts’ average price target on SOFI stock is $9.09, implying a 23.51% upside potential from current levels.

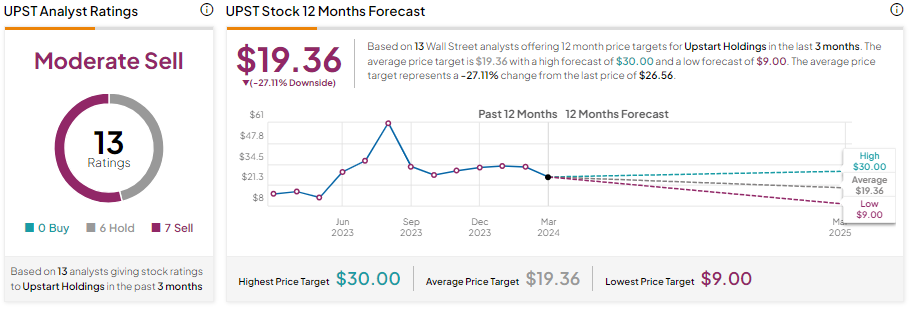

What is the Outlook for UPST stock?

The reduction in interest rates will likely provide solid growth opportunities for UPST by driving loans and third-party capital to meet its borrower’s demand. However, in the short term, a difficult lending environment and challenges in the funding markets could remain a drag.

Despite the recent decline in UPST’s share price, analysts maintain a bearish outlook on UPST. It has six Hold and seven Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target on UPST stock is $9.09, implying a 23.51% upside potential from current levels.