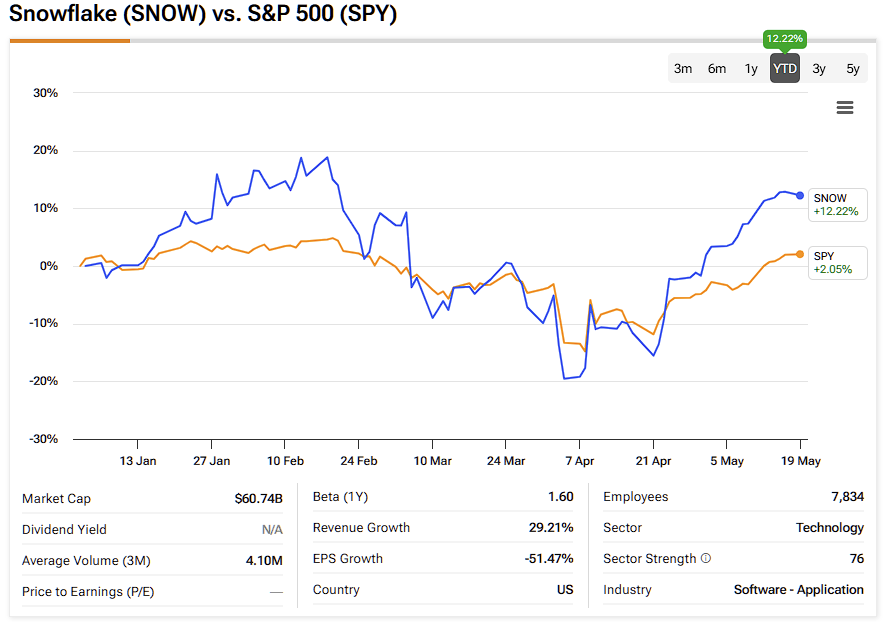

Market expectations are sky-high for Snowflake (SNOW) going into its quarterly earnings announcement tomorrow. The stock has posted a robust 41% gain in the past six months, but now comes a time of reckoning for the stock that has promised so much and delivered.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Market analysts expect SNOW to announce boosted earnings per share of $0.21, up ~50% year-over-year. The rather lofty earnings expectations are equally matched by revenues. Analysts are anticipating news of SNOW’s revenues rising 18% to break the $1 billion barrier. Can it continue on its merry way without hiccups of any sort? The answer, it seems, is maybe.

The data cloud titan benefits from accelerating cloud migrations and surging artificial intelligence (AI) interest. The upcoming earnings report will be a critical validator for recent stock gains. However, Snowflake’s valuation should be a cause for concern for investors, as less-than-perfect performance could drive its stock back to earth. This makes me neutral on SNOW, at least for the time being. Ultimately, I think there is a golden nugget here, but now may not be the time to grab hold of it.

Cloud Migration and AI Fuel Snowflake’s Growth Engine

Snowflake has two growth engines: cloud migration and AI data cloud. The former comes when enterprises are aggressively modernizing their data infrastructure. Snowflake goes out of its way to make the transition as easy as possible with tools like SnowConvert. This tool is freely available and is used to accelerate migrations from systems like Teradata and Oracle (ORCL), which are key competitors of Snowflake.

AI is undergoing a transition of its own. Enterprises are gradually adopting AI solutions, and they need a cloud to store, process, and build AI models directly on their data. Snowflake offers multiple products in this vein. Snowpark, for instance, allows developers to build data pipelines and machine learning models within Snowflake. The company aims to become an easy-to-use, comprehensive platform where companies can consolidate their data and run several workloads.

Decoding SNOW’s Lofty P/FCF Ratio

It’s no surprise that Snowflake commands a premium valuation. Its cloud-based products are highly scalable, capital-light, and generate strong recurring revenue—all characteristics that support high margins. As a result, the stock currently trades at a Price/Free Cash Flow ratio of 64.64, meaning investors are paying $64.64 for every $1 of expected annual free cash flow.

For perspective, the broader market typically trades in the 15–25 range. However, software-as-a-service (SaaS) companies like Snowflake often justify higher multiples due to their ability to convert revenue into cash more efficiently than firms with physical product lines.

SNOW’s Growth Meets Market Headwinds

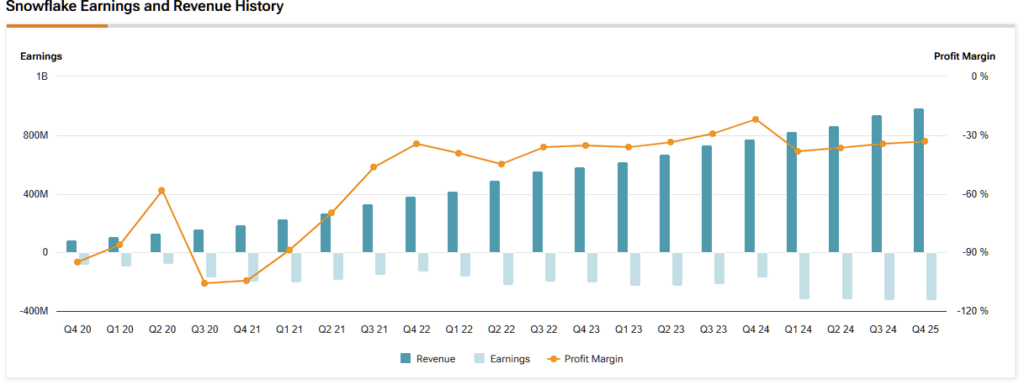

In FY2025, Snowflake reported $3.5 billion in product revenue, reflecting 30% year-over-year growth. For the first quarter of fiscal 2026, the company has guided revenue between $955 million and $960 million, representing 21% to 22% growth.

However, several factors could challenge Snowflake’s ability to sustain this pace. While its consumption-based, pay-as-you-go model offers flexibility to customers, it can introduce revenue volatility, especially if clients scale back usage amid cost-cutting efforts or uncertain macroeconomic conditions. Additionally, Snowflake faces stiff competition from cloud hyperscalers like Amazon (AMZN), Alphabet (GOOGL), Microsoft (MSFT), and Databricks.

While its multi-cloud, cloud-agnostic architecture and ease of use provide differentiation, these advantages may not fully offset the scale and resources of larger rivals over time. Moreover, stock-based compensation remains a significant expense, weighing on GAAP profitability—a common concern in the SaaS sector.

Is Snowflake a Buy, Sell, or Hold?

On Wall Street, SNOW earns a Strong Buy consensus rating based on 32 Buy, six Hold, and zero Sell ratings in the past three months. SNOW’s average stock price target of $204.97 implies ~13% upside potential in the next 12 months.

Analyst Derrick Wood from TD Cowen is bullish on SNOW. He has a Buy rating with a price target of $210. The analyst highlights Snowflake’s new products, like Data Engineering and Cortex AI, and believes the company will be resilient to macroeconomic headwinds. Lastly, he cited the company’s partnerships with OpenAI and Azure as enhancing its data-handling capabilities.

Not everyone is as bullish, however. Steven Koenig from Macquarie rates SNOW a Hold in April with a price target of $160, implying ~12% downside. Notably, he points to risks from “more aggressive FY26 product revenue guidance, competitors’ AI positioning, and macro pressures on consumption.”

Patience is a Virtue with SNOW Stock

In summary, while Snowflake is well-positioned in the rapidly expanding AI and cloud infrastructure space, it faces mounting competition from both established tech giants and emerging players. Its consumption-based revenue model, though flexible, remains vulnerable to macroeconomic pressures—particularly in cost-conscious environments. Given its premium valuation, currently at 64x times free cash flow, there is little margin for error. Any indication of slowing growth could prompt a sharp market reaction.

In summary, while Snowflake is well-positioned in the rapidly expanding AI and cloud infrastructure space, it faces mounting competition from both established tech giants and emerging players. Its consumption-based revenue model, though flexible, remains vulnerable to macroeconomic pressures, particularly in cost-conscious environments. Given its premium valuation, currently at 64.64 times free cash flow, there is little margin for error. Any indication of slowing growth could prompt a sharp market reaction.