Social media platform Snap (NYSE:SNAP) started testing a program, Snap Star, last year to woo content creators to post more videos on its app. With the full-fledged rollout of the program this year, Snap is witnessing that creators are flocking back to the app.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Snap Star program is a revenue-sharing deal that pays creators a part of the advertising dollars for the ads that are run in between their videos. SNAP stock is up nearly 32% year-to-date, compared to losing 16.9% in the past year.

Win-Win Situation for both Creators and SNAP

Snapchat’s revenue has been declining over the past several quarters owing to a pullback by corporate advertising, weakening user engagement, and partly because of Apple’s (NASDAQ:AAPL) privacy policy changes imposed last year. As per a Wall Street Journal report, the Snap Star program has already attracted some big names to the Snapchat app who left last year amid the app’s declining popularity.

Creators prefer the revenue-sharing model because they earn more dollars in this form compared to flat payout fees. Although the agreement does not prohibit creators from posting on other apps, those who are happy with the bigger payouts are posting solely on Snapchat. A Snapchat spokeswoman said that since the program’s rollout, user engagement on Snapchat Stories from creators in the model has more than doubled.

As per the TipRanks Website Traffic tool, the number of unique visitors on Snap increased a whopping 120.22% in the quarter ending June 30, 2023, compared to the same period last year. The figures below clearly indicate the growing popularity of the app since the launch of the new revenue-sharing agreement.

Snap has not shared the details of the percentage it shares with creators in the program. Competitors also resort to similar programs to attract famous personalities to their apps. Alphabet’s (NASDAQ:GOOGL) YouTube shells out roughly 45% to creators for posting short-form videos on its platform. In comparison, the Chinese application TikTok offers payouts of up to 50%.

Is Snap a Buy or Hold?

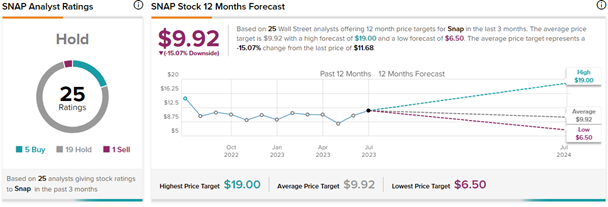

On TipRanks, SNAP has a Hold consensus rating based on five Buys, 19 Holds, and one Sell rating. The average Snap price target of $9.92 implies 15.1% downside potential from current levels.