According to reports, Snap Inc. (NYSE:SNAP) is said to be considering leveraging its AI chatbot, known as My AI, launched in February, as a means to strengthen its advertising business. By utilizing user engagement with the chatbot, the social media firm aims to improve the customization of advertising campaigns within its Snapchat application.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In addition, Snap is currently experimenting with various approaches to integrating the chatbot into its advertising initiatives. One strategy involves incorporating sponsored links from advertisers within conversations with My AI. For instance, if the conversation revolves around apparel, a relevant product link from an advertiser may be included.

Before the introduction of My AI, Snap relied on gathering insights from videos that users watched in Snapchat’s publicly posted stories or Spotlight video feed. However, these methods were not entirely effective in providing accurate information about consumers’ interests.

Generative AI has set markets on fire as it easily and speedily handles consumer-facing roles by answering questions within seconds. In this regard, Alphabet’s (GOOGL) Google recently introduced a new AI tool, Virtual Try-on, which aids consumers in clothes shopping.

My AI’s Success

It is worth mentioning that SNAP’s chatbot has received an impressive response since its launch, with approximately 10 billion messages sent to it thus far. This accounts for around 20% of Snapchat’s monthly users engaging with the chatbot on various topics such as shopping, gadgets, travel, and more.

Moreover, the chatbot helped boost Snap’s paid user count. In April, the company said that subscribers for its Snapchat+, paid subscription service crossed over the 3 million mark as customers rushed to access the AI chatbot.

Is SNAP a Buy, Sell, or Hold?

Currently, analysts are sidelined on SNAP stock with a Hold consensus rating. This is based on five Buy, 19 Hold, and one Sell recommendations. The average price target of $9.92 implies 6.6% downside potential from the current level. The stock is up 20.5% so far in 2023.

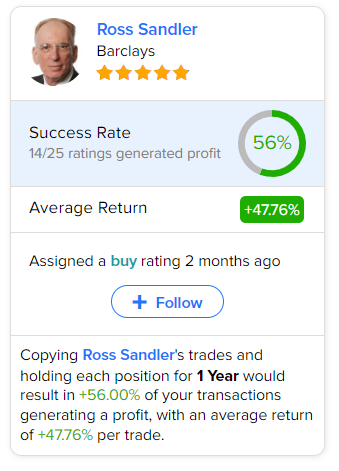

As per TipRanks data, the most accurate and profitable analyst for Snap is Barclays analyst Ross Sandler. Copying the analyst’s trades on this stock and holding each position for one year could result in 56% of your transactions generating a profit, with an average return of 47.76% per trade.