A class action lawsuit was filed against Snap Inc. (SNAP) by Levi & Korsinsky on August 21, 2025. The plaintiffs (shareholders) alleged that they bought SNAP stock at artificially inflated prices between April 29, 2025, and August 5, 2025 (Class Period) and are now seeking compensation for their financial losses. Investors who bought Snap stock during that period can click here to learn about joining the lawsuit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Snap is an American technology company that operates the popular “visual messaging” app called Snapchat. The company connects brands and direct response (DR) advertisers to customers through the Snapchat platform.

The company reports an average of 469 million daily active users (DAUs) on Snapchat and 932 million monthly active users (MAUs). It also states that the majority of people aged 13 to 34 in over 25 countries use Snapchat.

Snap’s tall claims about its advertising revenue growth are at the heart of the current complaint.

Snap’s Misleading Claims

According to the lawsuit, Snap and two of its senior officers (the Defendants) repeatedly made false and misleading public statements throughout the Class Period. In particular, they are accused of omitting truthful information about the company’s advertising revenue growth rate from SEC filings and related material.

During the Class Period, the defendants kept reiterating the company’s continued growth expectations. In an earnings call, Snap’s CEO highlighted progress on its advertising platform and confidence in achieving stronger performance, positive free cash flow, and progress toward GAAP profitability. The CFO also noted revenue growth but cautioned about early-quarter headwinds and the need to balance investments with revenue growth.

In the Q&A session that followed, the CFO said the focus was on execution and highlighted 60% growth in active advertisers and DR ad revenue reaching 70% of total ad revenue.

Moreover, the CEO said in response to a question that the company has a strong product roadmap, including goal-based bidding and dynamic product ads to be rolled out during the year.

Answering another question, the CEO said that Snap does not expect any further declines in North America in Q2, citing strong engagement with users creating and sharing snaps.

However, subsequent events (detailed below) revealed that the defendants overstated expectations for advertising revenue growth, which were highly unlikely to be met.

Plaintiffs’ Arguments

The plaintiffs maintain that the defendants deceived investors by lying and withholding critical information about the company’s business during the Class Period. Importantly, the defendants failed to inform investors that Snap would be unable to deliver on the forecasted advertising revenue growth due to its own execution failures.

The information became clear on August 5, 2025, when Snap released disappointing results for its second quarter of fiscal 2025. The company revealed that its advertising growth rate had significantly declined from 9% in the first quarter to only 1% in April. Snap attributed the slowdown to an issue related to its own ad platform, the timing of Ramadan, and the effects of the de minimis changes. Following the news, SNAP stock plunged 17.2% the next day.

For context, the U.S. ended the de minimis exemption on August 29, 2025, making all imports subject to duties and customs processing regardless of value. This raised costs for Snap’s advertisers, especially Chinese e-commerce businesses, leading to reduced ad spending and impacting Snap’s revenue growth.

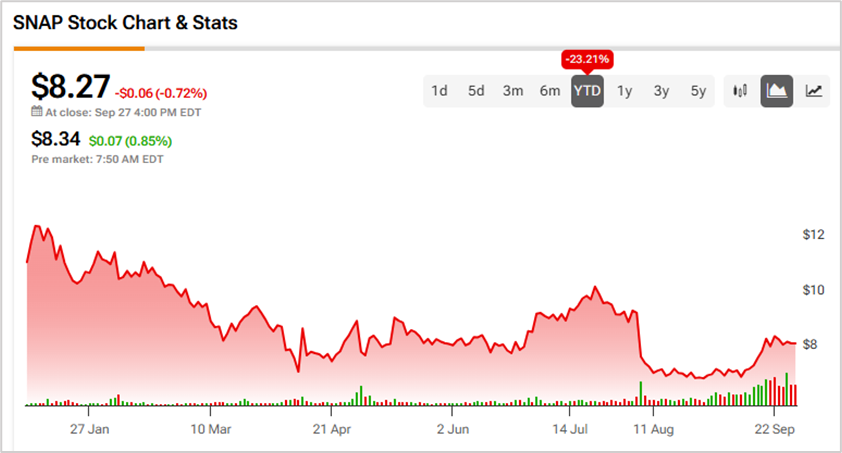

To conclude, the defendants failed to inform investors of the potential impact on Snap’s advertising revenue growth from the de minimis changes. Due to these issues, SNAP stock has lost 23.2% so far this year.