Shares of Snap (NYSE:SNAP) vaulted over 27% higher in after-hours trading after it provided a surprisingly strong quarterly earnings report. The social media giant reported a first-quarter adjusted profit of $0.03 per share on revenue of $1.19 billion. This beat analysts’ expectations of -$0.26 per share and revenue of $1.12 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These results are a significant improvement from the same quarter of last year, which was the first in the company’s history to see a revenue decline. The improvement can be attributed to growing advertising sales and an expanding user base on its Snapchat platform.

Furthermore, Snap’s advertising revenue increased by 16% year-over-year to $1.11 billion, while daily active users (DAUs) reached 422 million, up 10% from last year. The company has also been successful in diversifying its income streams, as its Snapchat+ subscription service has grown to over 9 million members.

Looking ahead to the second quarter, Snap anticipates revenue to come in between $1.225 billion and $1.255 billion. This represents a 15% to 18% growth year-over-year and beats the consensus estimate of $1.21 billion. The company also expects to end Q2 with around 431 million DAUs and projects an adjusted EBITDA of between $15 million and $45 million.

Is SNAP a Buy or Hold

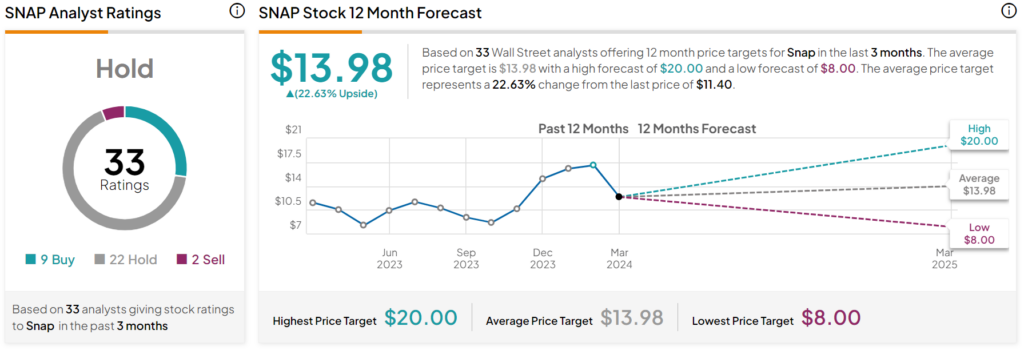

Turning to Wall Street, analysts have a Hold consensus rating on SNAP stock based on nine Buys, 22 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 16% rally in its share price over the past year, the average SNAP price target of $13.98 per share implies 22.63% upside potential. However, it’s worth noting that estimates will change following today’s earnings report.