Super Micro Computer (SMCI) was upgraded from a “Hold” rating to “Buy” by Argus Research analyst Jim Kelleher, despite the company’s weak Q1 results. He also assigned a new Street-high price target of $64 on the stock, implying 58.6% upside potential from current levels. Kelleher highlighted that Supermicro has built a $13 billion backlog for its Nvidia (NVDA) Blackwell-based platforms and is also shipping products using AMD’s (AMD) MI300X series GPUs (graphics processing units).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SMCI’s sales of $5 billion missed the consensus estimate of $5.83 billion, and earnings per share of $0.35 were lower than the consensus of $0.38. Even so, SMCI gave a positive revenue outlook for the current quarter, saying demand for its AI servers remains strong.

Kelleher is a five-star analyst on TipRanks, ranking #30 out of 10,109 analysts tracked. He has a 70% success rate and an impressive average return per rating of 30.10%.

SMCI Clears Financial and Regulatory Hurdles

Kelleher noted that the company’s recent struggles with revenue and margin shortfalls are already reflected in the current stock price. However, he believes investors are overlooking the company’s strong potential for future growth, which prompted the rating upgrade.

He noted that SMCI now meets all of Nasdaq’s filing requirements and is no longer burdened by regulatory issues. He also stated that generative AI is creating huge demand for Supermicro’s products, especially those that need advanced liquid-cooled rack systems.

Analyst Says SMCI Stock Is Undervalued

Kelleher added that although SMCI’s shares have risen more than 50% over the past year, they are still trading at less than half the peak price seen in early 2024. This shows strong market interest but also room for growth given past highs, prompting him to assign a high price target to the stock.

Supermicro began full production of Nvidia Blackwell rack-scale solutions with HGX B200 GPUs in February 2025 and is now ramping up B300 and GB300 platforms. Despite a stock drop after Q4 earnings and some investor skepticism, Kelleher sees the shares as undervalued given strong demand, advanced cooling tech, and a large backlog pointing to future growth.

Is SMCI Stock a Buy?

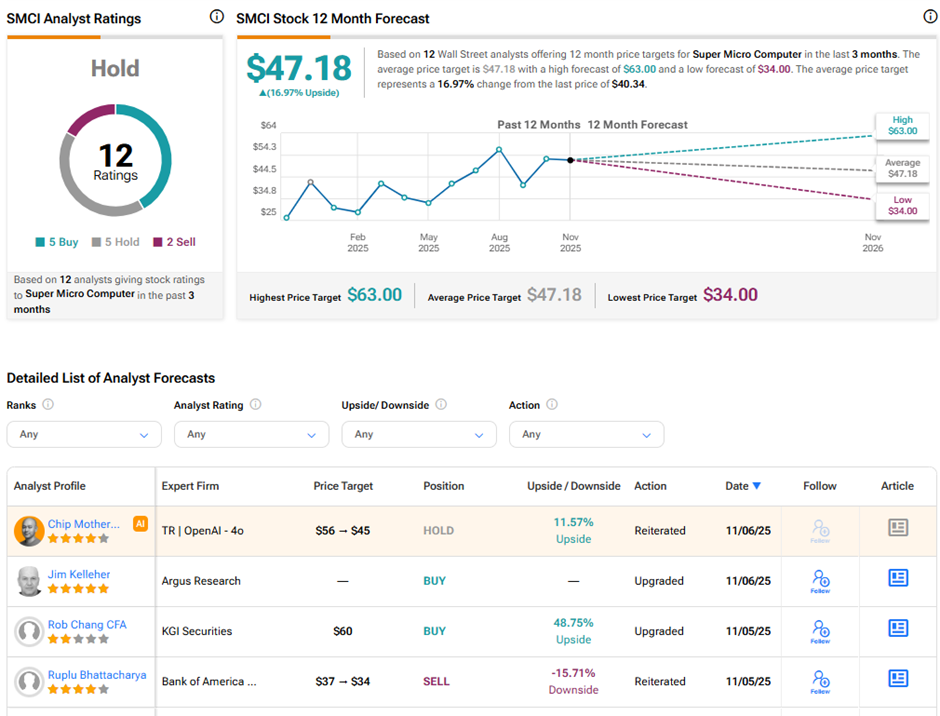

Not all analysts share Kelleher’s enthusiasm. On TipRanks, SMCI stock has a Hold consensus rating based on five Buys, five Holds, and two Sell ratings. The average Super Micro Computer price target of $47.18 implies nearly 17% upside potential from current levels.