Super Micro Computer (NASDAQ:SMCI) will announce its Q3 earnings on Tuesday, April 30. However, unlike its history, SMCI has not issued any positive business updates for Q3 ahead of the earnings, which raises concerns. Highlighting the same, Wells Fargo analyst Aaron Rakers said that the absence of a positive preannouncement could be seen as a negative indicator. The five-star analyst reiterated a Hold on SMCI stock on April 19. Rakers’ price target of $960 implies a 34.52% upside potential from current levels.

Super Micro Computer, which provides high-performance server and storage solutions, seems to be under pressure. Its stock fell over 29% so far in April. Nonetheless, individual investors have a Very Positive view of SMCI stock.

Over the past 30 days, the number of portfolios (tracked by TipRanks) holding the stock has increased by an impressive 19.9%. This indicates that these investors are buying the dip in SMCI stock, which has gained significantly from artificial intelligence (AI)-driven demand.

SMCI Stock: Q3 Expectations

Wall Street expects SMCI to report sales of $4.01 billion in Q3, up significantly from net sales of $1.28 billion in the prior-year quarter. Further, analysts’ estimates are within management’s guidance range of $3.7 billion to $4.1 billion. The company’s top-line numbers should benefit from solid demand for its products, customer wins, and improving supply conditions for GPUs and related key system components.

Thanks to the strong revenue growth, analysts expect SMCI to report earnings of $5.83 per share, up significantly from $1.63 in the same quarter last year.

What Is the Forecast for SMCI?

While SMCI stock has witnessed a pullback ahead of its earnings, it is still up about 151% year-to-date. Moreover, it has appreciated nearly 624% in one year. Given the significant rally, analysts are cautiously optimistic about SMCI stock.

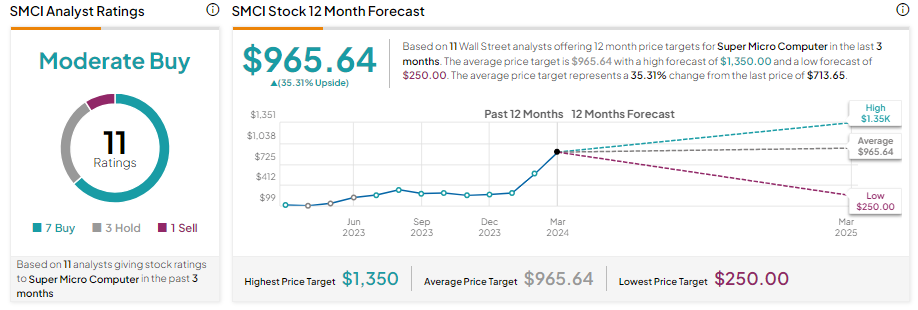

SMCI stock has seven Buys, three Holds, and one Sell recommendation for a Moderate Buy consensus rating. Analysts’ average SMCI stock price target of $965.64 implies 35.31% upside potential from current levels.