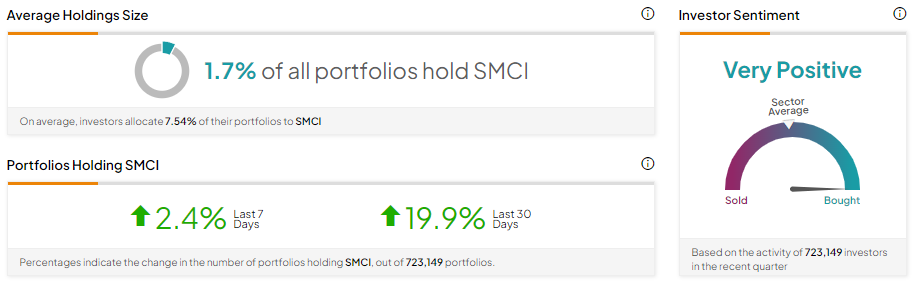

Super Micro Computer (NASDAQ:SMCI) stock has witnessed a pullback, declining about 17% in one month. While SMCI stock lost value, individual investors have a Very Positive view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 19.9%. This suggests that these investors are capitalizing on the dip to take long positions in SMCI stock, which is benefitting from the growing artificial intelligence (AI)-driven demand.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company provides high-performance server and storage solutions.

Overall, among the 723,149 portfolios monitored by TipRanks, 1.7% have invested in SMCI stock.

Learn more about TipRanks’ powerful Investor Sentiment tool here.

What Is the Forecast for SMCI?

SMCI stock is up about 216% year-to-date. Moreover, it gained nearly 714% in one year, driven by a surge in demand led by AI. Further, the company continues to win new customers with its AI infrastructure products and is diversifying its portfolio to capitalize on the growing generative AI market.

However, as Super Micro Computer stock has risen considerably, Wall Street is cautiously optimistic about its prospects. SMCI stock sports a Moderate Buy consensus rating, reflecting seven Buy, three Hold, and one Sell recommendations. Analysts’ average price target on SMCI stock is $965.64, implying 7.47% upside potential from current levels.