It was a bit of a rough night for Sleep Country (TSE:ZZZ), but not that rough. It brought out its third-quarter earnings figures, but though it didn’t quite pass muster, the news was good enough for investors to give Sleep Country a fractional boost in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The earnings report wasn’t great, but it was far from a disaster. Sleep Country posted earnings of C$0.76 (about US$0.55), which was down from the third quarter of 2022, when earnings came in at C$0.89 per share. Meanwhile, revenues were up somewhat, going from C$251 million in 2022’s third quarter to C$255.7 million in 2023’s third quarter.

Yet even as revenue was up, same-store sales were down, dropping 5.5% overall. The problem was largely what you’d expect the problem to be: declining consumer demand, hesitancy to spend on large-ticket items like mattresses, rising interest rates that make credit tougher to come by, and general issues of consumer confidence.

But Sleep Country isn’t taking this lying down. It’s recently juggled its board, as Zabeen Hirji is stepping down from the board of directors, planning to “…pursue other business and personal endeavors.” David Shaw will be stepping into her position as Chair of Human Resources and Compensation, reports note.

Further, Sleep Country also opened up a new store along with Silk & Snow. Known as a “collaborative store,” this is the first store of its kind opening up in the Westboro neighborhood of Ottawa. Since Silk & Snow is a “…premium sleep and lifestyle banner brand,” the likely hope is that the two together will inspire spending as shoppers look to make their homes more inviting.

Is Sleep Country a Good Stock to Buy?

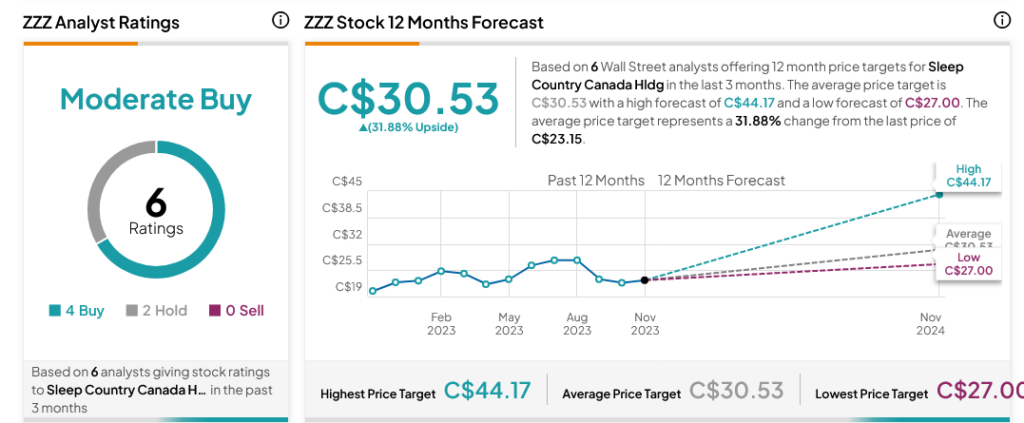

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ZZZ stock based on four Buys and two Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average ZZZ price target of C$30.53 Canadian per share implies 31.88% upside potential.