Silvergate Capital (NYSE: SI) shares jumped 9% on April 19, after the company delivered a blowout first-quarter results impressively topping earnings expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Robust growth in customers, Silvergate Exchange Network (SEN) leverage commitments as well as average deposits drove results, despite challenges faced by the broader industry.

Based in California, Silvergate Capital is the parent company of Silvergate Bank, which is a Federal Reserve member bank and the leading provider of innovative financial infrastructure solutions and services for the growing digital currency world.

Q1 Beat

The company reported stellar quarterly earnings of $0.79 per share, significantly higher than analysts’ estimates of $0.44 per share and much higher than the earnings of $0.55 per share reported for the prior-year period.

The net interest margin came in at 1.36% in the quarter, up 25 basis points sequentially and also up 3 basis points from the year-ago period.

The growth was driven by a higher proportion of securities and a lower proportion of interest-earning deposits in other banks as a percentage of interest-earning assets.

Further, the company’s digital currency customers increased to 1,503 at the end of the quarter compared to 1,381 on December 31, 2021, and from 1,104 on March 31, 2021.

The provision for credit losses was a reversal of $2.5 million in the quarter compared to a nil provision for both prior quarter and prior-year quarters.

CEO Comments

Shedding light on the strategic plans, Silvergate CEO, Alan Lane, stated, “To advance our customer-first approach, we continued to invest in our strategic initiatives, including stablecoin infrastructure through the acquisition of select blockchain-based payment technology assets from the Diem Group, and the launch of the Euro SEN. I look forward to the rest of 2022 and I am excited for what lies ahead for Silvergate.”

Analysts Recommendation

Consensus among analysts is a Strong Buy based on five unanimous Buys. The average Silvergate Capital analyst price target of $199.29 implies 46.74% upside potential to current levels.

Investors Weigh In

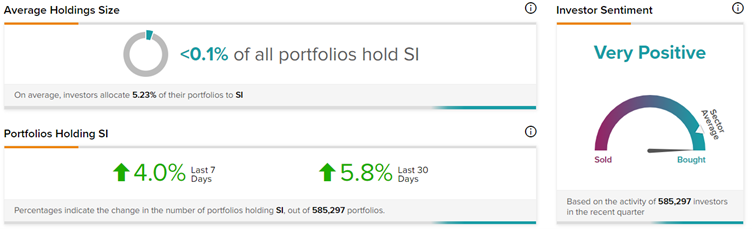

At the time of writing, TipRanks’ Stock Investors tool showed that investors currently have a Very Positive stance on Silvergate, with 5.8% of investors increasing their exposure to SI stock over the past 30 days.

Conclusion

Silvergate has outperformed despite the recent challenges facing the broader crypto ecosystem and the macro economy. The jump in share price following the upbeat results reflects investors’ belief in the strength of Silvergate’s business platform, further boosted by its company initiatives.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Synchrony Financial Shares Gains 6.2% on Q1 Beat

Bank of New York Mellon Posts Mixed Q1 Results

Charles Schwab Tanks 9.5% on Q1 Miss