Glaucoma: for those of a certain age, it’s a huge concern that could cost you your eyesight. For those not quite there, it’s usually a way to get medical marijuana. But for Sight Sciences (NASDAQ:SGHT), it prompted a massive 48% jump in share prices in Tuesday’s trading. When it passed the 43% mark, that represented the biggest intraday gain it had ever seen. And it’s only been on the rise since. The reason behind this latest surge stems from news about Medicare coverage for Sight Systems’ micro-invasive surgical procedure (MIGS) to treat glaucoma.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Back in October, there were concerns that the MIGS wouldn’t be used much in treating glaucoma, and that sent shares plummeting downward. Yet, word out of Wells Fargo analyst Larry Biegelsen suggests that the early word about Medicare limiting support for MIGS may not actually go through. Biegelsen looks to the American Glaucoma Society, who offered commentary that should put some support behind MIGS.

Not Just Glaucoma, Either

A glaucoma treatment will not only prove welcome for seniors but also for Sight Sciences itself. But there’s more in Sight Sciences’ arsenal than just a glaucoma treatment. Recently, it brought out word about the results of its SAHARA treatment for dry eye disease. Known as TearCare, the latest data suggests that TearCare is a match for the leading prescription for fighting the disease. It actually managed to beat out the leading treatment, Restasis, in several cases, making it a potential winner to come.

What is the Price Target for SGHT?

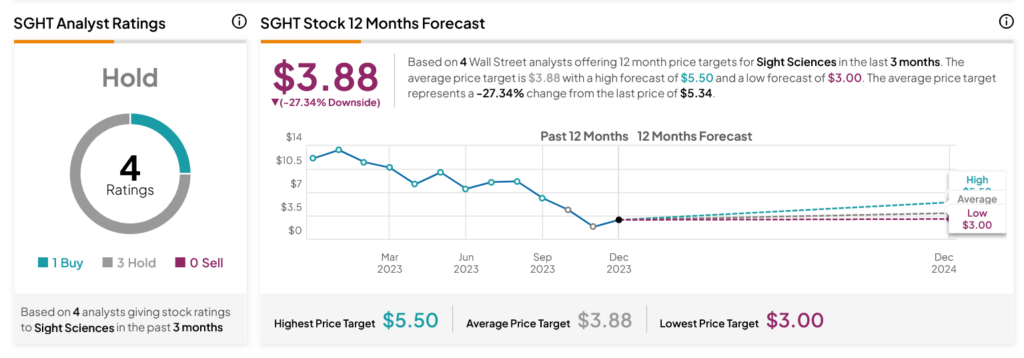

Turning to Wall Street, analysts have a Hold consensus rating on SGHT stock based on one Buy and three Holds assigned in the past three months, as indicated by the graphic below. After a 53.81% loss in its share price over the past year, the average SGHT price target of $3.88 per share implies 27.34% downside risk.