Looking to invest in tech stocks but confused about which ones to include in your portfolio? Well, this problem of plenty can be solved with Invesco QQQ Trust (NASDAQ:QQQ), one of the biggest NASDAQ 100 index (NDX)-tracking exchange-traded funds (ETF). Interestingly, the ETF has advanced more than 27% year-to-date, outperforming the 10% rise in the S&P 500 Index (SPX).

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Remarkably, QQQ has delivered an average annualized return of 17.7% in the past decade, ending in March 2023. Moreover, QQQ has beaten the S&P 500 (SPX) nine out of the last ten years. Further, the ETF has a low expense ratio (cost of managing the ETF) of 0.20%, which makes it an attractive investment.

It is worth mentioning that as per 1,701 analysts providing ratings on QQQ’s 102 holdings, the ETF is a Moderate Buy and the average price target of $366.70 implies a 9% upside. Further, 66.49% of ratings are Buys, 29.51% are Holds, and nearly 4% are Sells.

Aside from analysts’ consensus, QQQ is a Buy based on the technical indicators. Additionally, the Invesco QQQ ETF has an Outperform Smart Score of eight on TipRanks, implying it is more likely to beat the broader market averages.

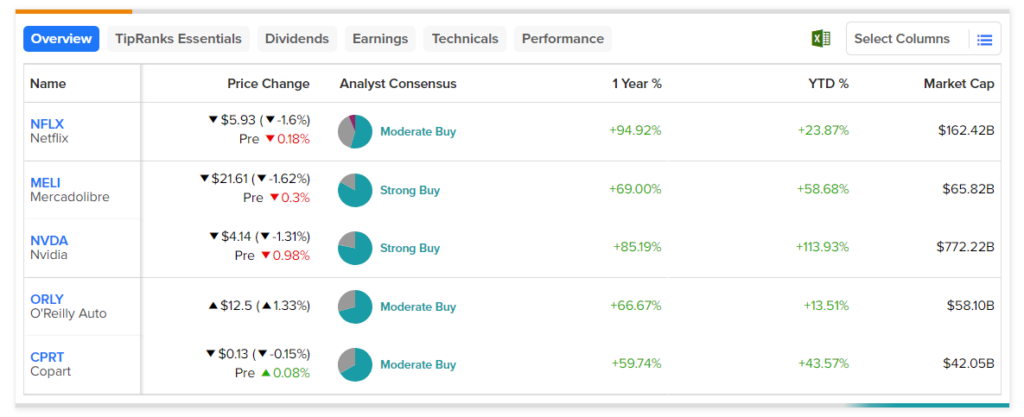

While most of the ETF’s holdings witnessed strong returns over the past year, there remain a few stars, having gained over 50%. Let’s take a look at the five best-performing stocks in the ETF:

- Netflix Inc. (NFLX)

- Nvidia Corporation (NVDA)

- Mercadolibre, Inc. (MELI)

- O’Reilly Automotive, Inc. (ORLY)

- Copart, Inc. (CPRT)