Based on any standard analytical methodology, TeraWulf (WULF) is admittedly challenging to justify. A leading provider of sustainable cryptocurrency mining solutions, WULF stock has naturally benefited from the stratospheric rise of blockchain assets. At the same time, prospective investors must carefully consider the fragility of the argument. Should the crypto sector tumble, WULF is likely to follow suit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s not just an empty warning, a gut reaction to WULF stock gaining an absurd 173% on a year-to-date basis. Instead, when the cycle no longer favors upside in digital assets, crypto-mining enterprises tend to suffer. In TeraWulf’s case, revenue declined from $17.62 million in 2019 to $15.03 million in 2022.

Currently, WULF stock trades at nearly 30x forward earnings. Earlier this year, the multiple was less than 12x. By logical deduction, if the underlying company fails to justify this premium, the equity’s value could correct abruptly. That’s the nature of the business.

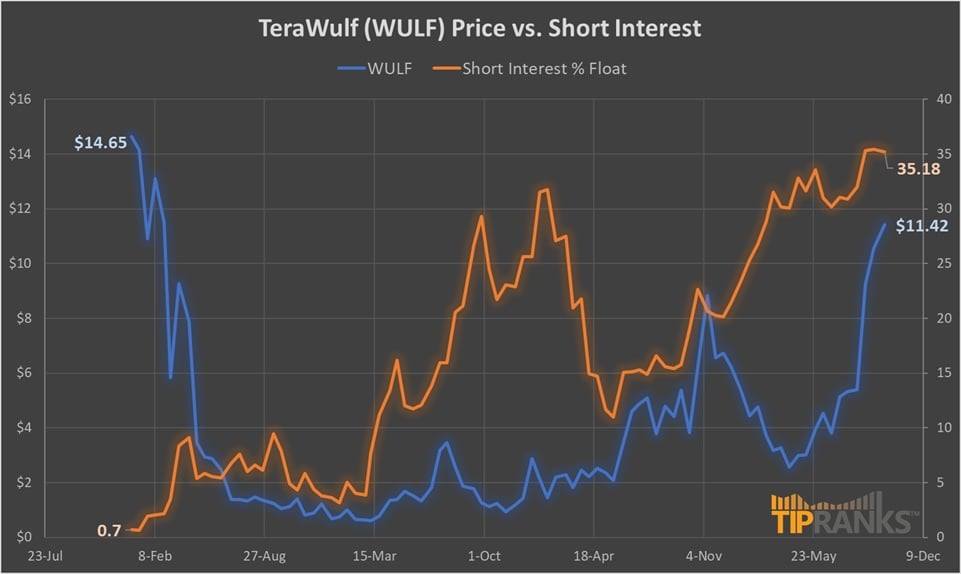

Still, for the moment, the bullish case arguably is the more credible. Yes, the central narrative centers on WULF’s high short interest and the possibility of a short squeeze, but it’s more than that. Rather, there appears to be a polarity flip in behavioral patterns that may offer speculative bulls confidence in TeraWulf.

Short Interest Soars for WULF Stock

Earlier this month, TipRanks data analytics partner Ortex.com noted that short interest in TeraWulf stock reached a record high of 38.9%, with the underlying ratio at 2.5 days to cover. While the former statistic is especially significant, it’s important to understand the mechanics behind short transactions to truly grasp the contrarian opportunity.

Under ordinary circumstances, people initiate a position by buying to open, which is also known as a debit-based transaction. Essentially, you pay a debit for the right to speculate on the directional trajectory of the asset. In contrast, a short position begins by selling to open the position. These transactions are credit-based because the securities loaned out for shorting activities originate from a creditor or broker.

Obviously, the idea behind a short trade is for the target security to fall in value. If it does, you can buy back the shares at a discounted price, return the original amount to the broker, and pocket the difference as profit. That’s all fine and well, so long as the security actually drops. If it instead rises in value, you risk crystallizing losses.

What’s worse, under that scenario, the lending broker must be made whole, irrespective of whatever happens to the security. After all, the shares that were shorted were done so on loan (or on credit). Therefore, a rapidly rising share price forces short traders to make difficult decisions — either be prudent and cut losses early or be stubborn and hope for a turnaround.

When short sellers rush to exit their positions, they trigger a surge in the stock’s price — because closing a short requires repurchasing the shares. This dynamic makes heavily shorted stocks especially prone to what’s called a short squeeze.

That said, not every position reflected in short interest is a bearish bet. Some are linked to market-making or hedging activity. Still, when more than 10% of a company’s float is sold short — and especially beyond 20% — it usually signals a significant degree of bearish sentiment. At around 40%? There’s no mistaking it — that level of short interest all but screams deep skepticism.

A Polarity Flip Seemingly Confirms a Behavioral Transition

Last year, TeraWulf generated $140 million in revenue, which, while impressive on a percentage basis relative to the prior year’s print of $69.23 million, is not all that endearing. So, why mention it? Bluntly speaking, WULF stock isn’t trading based on the fundamentals. Instead, it’s probably shooting higher on the prospect of a short squeeze.

Essentially, by concentrating bids on WULF stock, the security would naturally enjoy upward pressure — exactly what the bears don’t want to see. As the security continues moving northward, the bears’ tail risk (or the threat of an ever-rising obligatory payment as the underwritten event becomes fully realized) rises exponentially.

That could spark parabolic upside, irrespective of the fundamentals. Still, this tactic raises the question: how reliable is the thesis? Using data going back to December 2021, the median two-week return of WULF stock whenever its short interest was 20% or higher was 2.28%. On the other end, the median two-week return of WULF when short interest was below 20% was -2.64%.

That’s almost a five-percentage-point swing in median behavior and reflects a polarity. Basically, when short interest is highly elevated, WULF stock tends to have an upward bias. In any other circumstance, it has a negative bias.

Now, I haven’t run a statistical confidence test to determine if this polarity of sentiment could have materialized randomly, so there is some uncertainty in the analysis. Still, the deliberate bidding up of heavily shorted securities isn’t a new phenomenon — and I expect a continuation of the trend.

As such, from a pure speculative point of view, I wouldn’t be opposed to just outright buying the security in the open market. With this approach, you don’t have to worry about expiration dates. There’s nothing more frustrating than getting the thesis right but the timing wrong.

If you do want to speculate, I would look into long-expiry call options, which have relatively high liquidity for their maturity. For example, the bid-ask spread of the $17 call expiring Jan. 15, 2027, comes in at 5.71% at the midpoint. That’s not bad for a precarious stock option.

Is WULF a Good Stock to Buy?

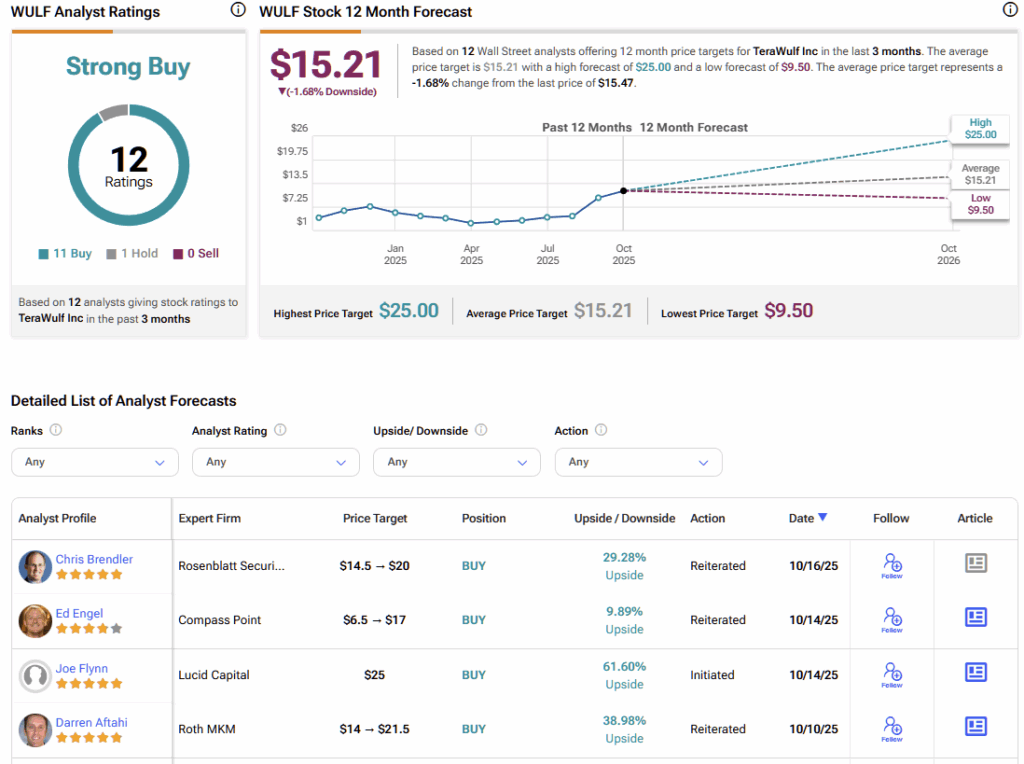

Turning to Wall Street, WULF stock carries a Strong Buy consensus rating based on 11 Buys, one Hold, and zero Sell ratings over the past three months. The average WULF stock price target is $15.21, implying approximately 1.7% downside risk over the coming year.

WULF Stock is an Enticing Wager Backed by Empirical Data

Under normal circumstances, investors should steer clear of TeraWulf. However, the argument here is that these are not normal circumstances. Instead, the high short interest and its observed shift in behavioral patterns suggest that an explosive squeeze could materialize. For some gamblers, that might be more than enough reason to consider WULF stock, especially with some loose pocket change.