For many out there, life doesn’t stop when the sun goes down. In fact, they prefer being up late much more so than they prefer being up early. But for buy now pay later leader Affirm Holdings (NASDAQ:AFRM), being up late is considered a “red flag” as far as creditworthiness goes. This wasn’t news investors cared for either, and they sent Affirm down over 7% in the closing minutes of Friday’s trading.

Affirm’s CEO, Michael Linford, revealed that Americans who shop online after midnight are more likely to not only make risky transactions, but also default on their loans. The hours in which a customer tries to conduct a transaction are actually part of the process that Affirm uses to determine whether or not to approve a loan. Affirm also uses its own payment history with a customer, and also uses credit data drawn from Experian. While certainly, the nature of buy-now-pay-later operations is different from standard credit lending, and thus can do well with different metrics, the time of day someone chooses to shop doesn’t exactly seem like the most reasonable metric.

Joining the Larger Crowd

Meanwhile, Affirm joined a growing crowd of tech firms that were laying off employees. A report from the Pittsburgh Post-Gazette revealed that a Worker Adjustment and Retraining Notification (WARN) notice was filed with the state’s Department of Labor and Industry over a planned layoff of 60 remote workers. The issue, reports note,was a matter of “…consolidat(ing) several operations teams,” which ultimately led to the dismissal of the 60 in question.

Is Affirm a Buy or a Hold?

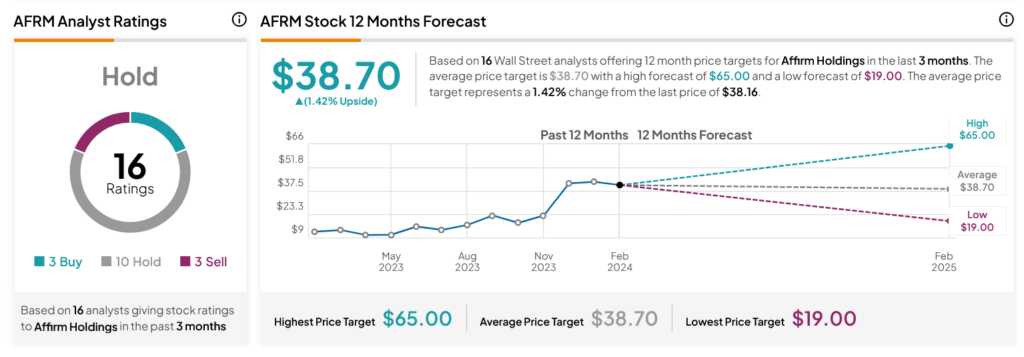

Turning to Wall Street, analysts have a Hold consensus rating on AFRM stock based on three Buys, 10 Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 196.53% rally in its share price over the past year, the average AFRM price target of $38.70 per share implies 1.42% upside potential.