What sent healthcare stock Shockwave Medical (NASDAQ:SWAV) up over 10% in Friday afternoon’s trading? A surprise bit of news about a possible new takeover brewing gave Shockwave stock new life and captured investors’ imaginations. Even more compelling was who may be interested in taking over.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A Bloomberg report noted that Boston Scientific (NYSE:BSX) has its eye on Shockwave in a bid to ramp up its operations in cardiovascular treatment devices. Rumors that Shockwave might have been in line for a takeover date all the way back to January 2022, when Shockwave was originally working with advisers to either merge with or set up a partnership with another company. If the deal goes through, it would represent the second-largest acquisition in Boston Scientific’s history, behind only the $27 billion purchase of Guidant Corp. back in 2006.

One of Shockwave’s biggest tools is a device that engages in “intravascular lithotripsy,” a means to use electrical impulses as a way to break deposits of calcium in the human bloodstream. Hence the name, Shockwave. Intravascular lithotripsy is in line to replace the current practice, known as “atherectomy,” which requires the use of a small drill in the bloodstream. Interestingly, the deal potential comes at the same time as a planned rule change at the Centers for Medicare and Medicaid services that would improve the use of intravascular lithotripsy by offering three new codes for the surgery that pay more.

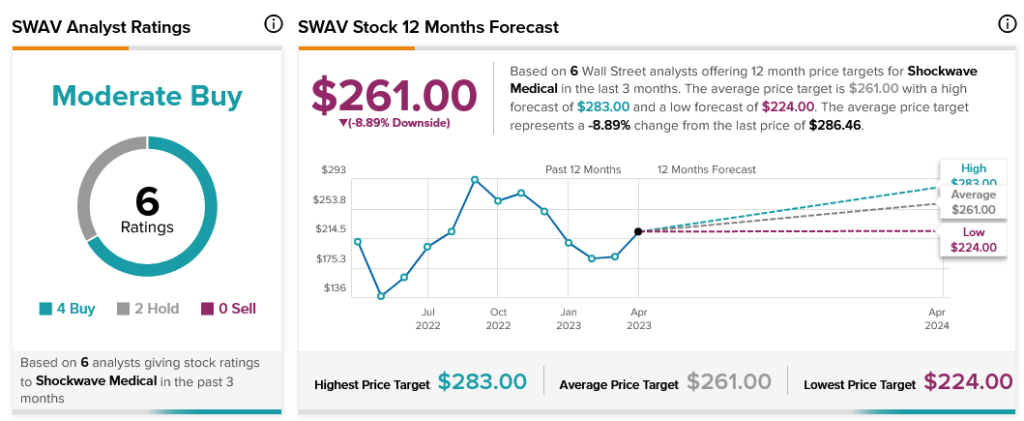

Whether or not the buyout happens, Shockwave Medical stock still has plenty of analyst support. It’s currently considered a Moderate Buy, with four Buy ratings and two Holds. However, SWAV also comes with a downside risk of 8.89%, thanks to its average price target of $261.