Shell (NYSE:SHEL) recently updated its outlook for the first quarter of 2023, which will be released on May 4, 2023. The oil and natural gas-producing company expects that its Integrated Gas Unit will perform better in Q1 while experiencing wider losses in the Corporate Unit.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Q1 LNG liquefaction volumes are anticipated to be in the range of 7-7.4 million tonnes (MT), up from the 6.6-7.2 MT the company guided during Q4 results. Higher uptime at the Prelude and QGC plants in Australia resulted in increased volumes. Further, the company lifted the lower end of its integrated gas production level range to 930,000 and 970,000 barrels per day.

Moreover, Shell projects the Upstream unit’s production to be between 1.8 million and 1.9 million barrels, up from the 1.75 million and 1.95 million barrels in the prior guidance range.

Additionally, Shell expects its Marketing division to perform better sequentially. The sale of oil products is expected to be between 2.25 million and 2.65 million barrels, against the 2.15 million and 2.65 million barrels range initially expected.

Lastly, the Corporate unit is expected to post a wider adjusted loss of $0.9 billion to $1.2 billion in the first quarter versus the previously guided range of $0.4 billion to $0.6 billion. The company attributed the higher loss to one-off tax charges.

Overall, Shell expects to pay Q1 taxes between $2.6 and $3.4 billion, down from $4.4 billion in the fourth quarter.

Is Shell a Good Stock to Buy?

Though lower oil prices have put pressure on the oil companies’ topline performance, strong demand growth may still be able to support them. Additionally, a solid cash flow position and successful capital deployment strategies increase shareholders’ faith in the stock.

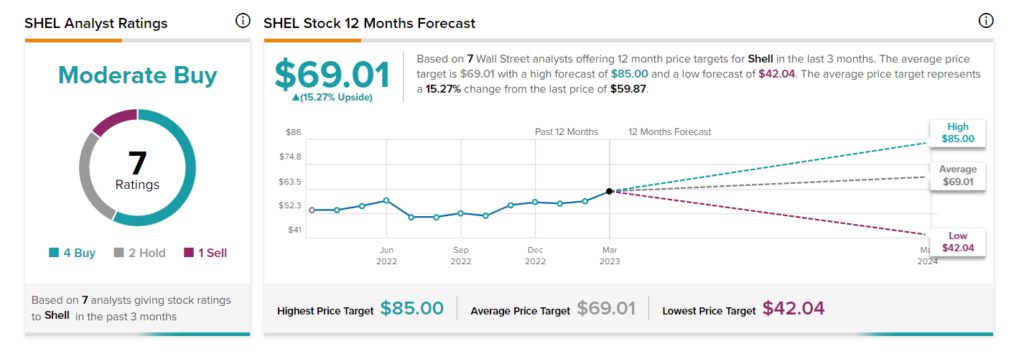

According to Wall Street, SHEL stock has a Moderate Buy consensus rating. This is based on four Buys, two Holds, and one Sell assigned in the past three months. The average price target of $69.01 implies 15.3% upside potential. The stock has gained 8% so far in 2023.