British oil giant, Shell’s (NYSE: SHEL) profits slumped in the second quarter with adjusted earnings of $0.74 per share as compared to $1.54 in the same period last year and fell short of consensus estimates of $1.70 per share. The lower-than-expected profits were a result of lower oil and gas prices, a slump in refining margins, lower volumes, and a fall in LNG trading and optimization results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s revenues slumped 25.4% year-over-year to $74.6 billion, beating analysts’ estimates of $66.8 billion.

Shell has announced a stock buyback of $3 billion, which is expected to be completed by the time the third quarter results are announced. The company raised its quarterly dividend by 15% to $0.331 per share.

In the fiscal third quarter, the company has projected adjusted earnings in the range of a negative $0.7 billion to a negative $0.5 billion. In FY23, Shell expects to incur a lower cash capex between $23 billion and $26 billion.

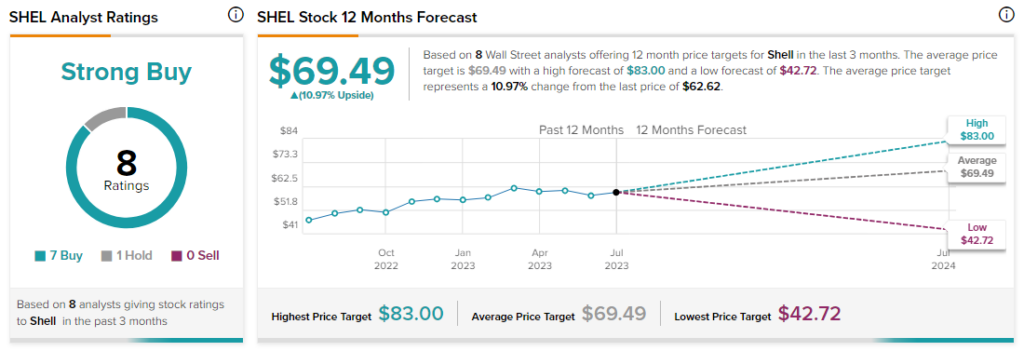

Analysts are bullish about SHEL stock with a Strong Buy consensus rating based on seven Buys and one Hold.