Shell (NYSE:SHEL) stock gained about 3% on Friday as investors were pleased with the company’s positive expectations for the third quarter of 2023, driven by rising energy prices. Also, SHEL expects to benefit from higher trading and optimization opportunities in its Integrated Gas and Chemicals & Products segments.

In the Integrated Gas segment, the expected Q3 LNG liquefaction volumes have been revised to a range of 6.6-7 million tonnes (MT), which is an increase from the previous guidance of 6.3-6.9 MT. Additionally, the company has narrowed the range for integrated gas production to 880,000-920,000 barrels per day. The adjustment is attributed to maintenance activities on assets in its Prelude floating LNG production facility offshore Australia and at the Atlantic LNG production plant in Trinidad and Tobago.

For the Upstream unit, Shell narrowed production expectations to be between 1.7 million and 1.8 million barrels, compared with 1.6 million and 1.8 million barrels in the prior guidance range.

Additionally, Shell expects its Marketing division results to be in line with the previous quarter. The company lowered the higher end of the oil product sales outlook to between 2.45 million and 2.85 million barrels, against the previously expected 2.45 million and 2.95 million barrels range.

Lastly, the Corporate unit is expected to post a narrower adjusted loss of $0.4 billion to $0.6 billion in the third quarter versus the previously guided range of $0.5 billion to $0.7 billion. SHEL is expected to report its third-quarter results on November 2.

It is worth mentioning that last week, ExxonMobil (XOM) also disclosed expectations of sequential growth in Q3 earnings due to higher oil and gas prices.

Volatile Oil Prices

The bottom lines of companies like SHEL and XOM were boosted last year as these oil giants benefitted from higher energy prices due to the war between Russia and Ukraine. However, in the first half of 2023, prices declined after reaching a peak in 2022. This decline can be largely attributed to an uptick in inventories. A decrease in demand from China, a major oil-importing nation, played a significant role in this downturn.

Recently, prices have once again risen, primarily due to the tightening oil supply and production cuts by Saudi Arabia and Russia. Going forward, the trend is expected to continue due to the ongoing Israel-Hamas conflict.

Is Shell Stock a Buy?

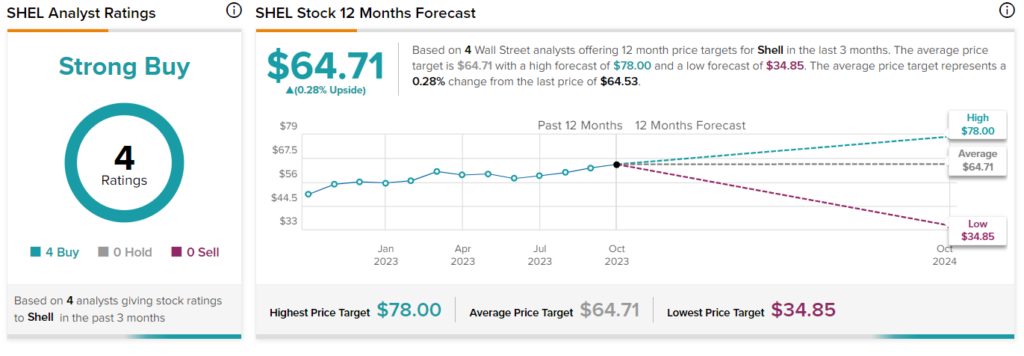

SHEL stock has a Strong Buy consensus rating on TipRanks based on four unanimous Buys assigned in the past three months. Meanwhile, the average price target of $64.71 implies only a marginal upside of 0.28%. The stock has gained 18.7% so far in 2023.