Energy major Shell (NYSE:SHEL) is going for a substantial headcount reduction in a bid to drive performance, as reported by Bloomberg. Jobs in the company’s low-carbon solutions business are the first to come under fire.

Last year, the company outlined a structural cost reduction plan to save nearly $3 billion by the end of 2025. This included the elimination of positions across multiple divisions. The British energy company is now lowering its headcount across corporate affairs, projects, and technology departments. Interestingly, the pivot towards driving valuation and a leaner setup includes lowering investments in clean energy. Hertz (NASDAQ:HTZ) took a similar approach last week by opting for internal combustion vehicles over EVs.

This move follows Shell’s recent sale of its Nigerian onshore subsidiary in a $2.4 billion deal. Earlier this week, the company suspended all shipments via the Red Sea amid fears of escalating regional conflicts. Since then, Iran and Pakistan have launched tit-for-tat missile strikes on each other. Both countries claimed to target terrorist operations in the strikes.

Meanwhile, Shell’s appeal against a major climate ruling is coming up in April. In 2021, a Dutch court ordered the company to lower its carbon emissions by nearly half by 2030. Shell is now seeking to overturn the verdict.

Is SHEL Stock a Buy, Sell, or a Hold?

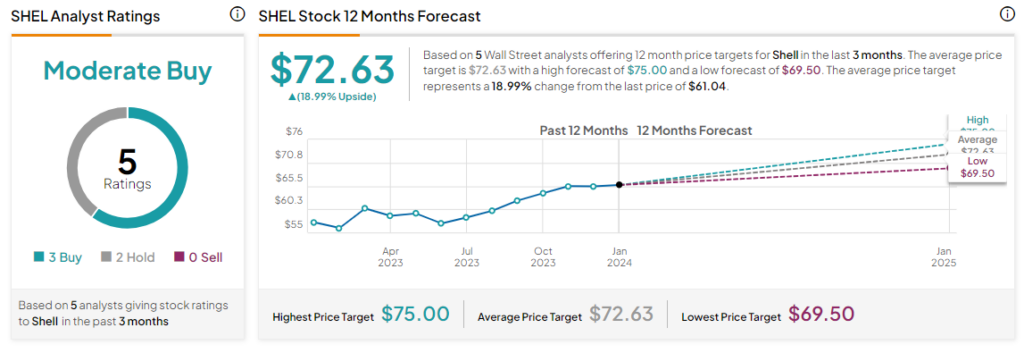

Amid these developments, Shell shares have sunk nearly 7% so far this month. Overall, the Street has a Moderate Buy consensus rating on Shell, and the average SHEL price target of $72.63 implies a nearly 19% potential upside in the stock.

Read full Disclosure