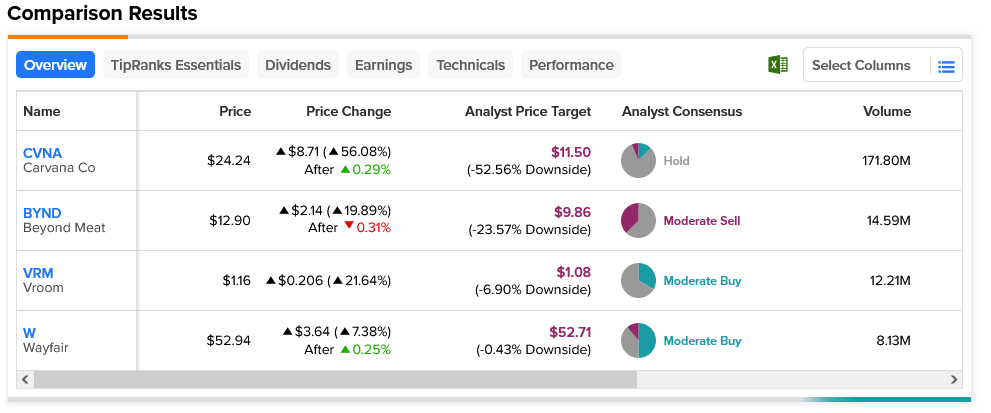

An unexpected development cropped up in today’s trading, and it featured several names that didn’t have a whole lot in common. From car sellers Carvana (NYSE:CVNA) and Vroom (NASDAQ:VRM) to imitation meat company Beyond Meat (NASDAQ:BYND) to online furniture seller Wayfair (NYSE:W), all four saw some unexpected gains in Thursday afternoon trading. That got some wondering if there was a short selling frenzy about to kick off.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, some of the gains in Thursday afternoon’s trading were impressive. Carvana closed up 56.08%, while Vroom closed up 21.64%. Beyond Meat saw a 19.89% gain, while even Wayfair had a decent day, gaining an extra 7.38%. Potential explanations behind the gains varied. Carvana had recently delivered positive guidance at an investor conference, which would account for at least some of the gains seen. Wayfair, meanwhile, also had a good reason for gains, though maybe not the ones we saw. Both Truist and Bank of America hiked price targets on Wayfair based on spending trends seen in the first quarter.

However, there’s not much going on to support the gains seen from the other stocks. They had lesser gains than Carvana did, certainly, but were definitely substantial nonetheless. That’s enough to make some analysts, based on a Seeking Alpha report, think that a short squeeze may be in the making on several stocks. The four we’ve seen today, for example, have a substantial short interest. Beyond Meat leads the pack with short interest, that’s 43.19% of the total float. That’s up from just this time last week, and the others have substantial short interest as well.

One other point these four stocks have in common is downside risk, though to different degrees. The lowest downside risk is with Wayfair, where its $52.71 average price target corresponds to 0.43%. It’s also considered a Moderate Buy by analyst consensus. Meanwhile, Carvana leads the pack in downside risk at 52.56%, thanks to an $11.50 average price target.