ServiceNow (NYSE:NOW), a workflow software provider for IT services, is trading at a high valuation after consistently achieving high revenue growth. Despite this elevated valuation, NOW’s focus on using AI to assist businesses suggests potential for further growth. With companies looking to use Gen AI to improve their bottom lines, ServiceNow aims to capitalize on that demand. The company’s strong cash flow position reinforces its capability to expand its market reach. As a result, I’m bullish on the stock.

NOW’s Trajectory: Climbing or Cresting?

ServiceNow’s revenue growth mirrors the market’s growing interest in AI. The company’s FY-2023 revenue reached $8.971 billion, achieving a 24% increase compared to the previous year. ServiceNow exhibits a remarkable ability to sustain strong growth, as evidenced by its impressive cash flow record. In FY 2023, the company’s annual free cash flow reached $2.704 billion, marking a 24.4% increase from the previous year.

Investors are paying a premium for NOW’s growth potential. ServiceNow’s forward P/E ratio is 58.8, a valuation more than twice as high as the industry average forward P/E ratio (27.48), making some analysts wary. Some investors are skeptical about whether ServiceNow can maintain the high growth trajectory that its historical performance has established. With its current high valuation, there’s added pressure on the company to continue its rapid expansion rate.

In spite of these reservations, analysts predict that ServiceNow’s revenue will grow 21% annually over the next three years. The forecast is a healthy margin above the industry average expected growth rate of 15%.

ServiceNow is counting on demand for AI-related software to achieve these gains, a bet that could pay off, considering AI’s expanding role across industries. As a result, investors are likely to gravitate towards NOW stock, drawn by its strong position in AI productivity software, robust cash flow, and its consistent history of growth.

NOW: Boosting Business Productivity with AI

ServiceNow’s Now platform uses generative AI to transform workflows previously managed by email or spreadsheets into more efficient processes. Its capability to automate a wide range of tasks saves customers money and reduces errors in workflows. As a result, the Now platform successfully attracted a significant number of large enterprise clients in FY 2023.

At the same time, the platform expanded its reach by adding over 400 new accounts, bringing the total number of customers to over 8,100.

ServiceNow is leveraging its AI capabilities to enhance user interactions. Last summer, ServiceNow launched Now Assist, a generative AI chatbot built to boost productivity by engaging users in dynamic conversations. The addition enhances ServiceNow’s approach of incorporating generative AI into the Now Platform.

ServiceNow believes it’s uniquely positioned to capitalize on generative AI. “There’s a real appetite to invest in Gen AI, and there’s no price sensitivity around it because the business cases are so unbelievable,” said ServiceNow CEO Bill McDermott. “I mean, if you’re improving productivity, 40%, 50%, it just sells itself. So, I think we’re in a really, really good place. The Gen AI investments are coming. We’re actually getting orders because we have a great product.”

Investment analysts appear to be on board, too. KeyBanc recently initiated coverage on shares of ServiceNow, assigning an Overweight rating and setting a price target of $1,000. The revised price target reflects the firm’s enhanced confidence in the company’s capacity to capitalize on AI, surpassing many of its large-cap competitors.

NOW Revenue Fortified by Loyal Subscription Base

ServiceNow’s strong financials are supported by a strong subscription base. Customer retention continues to excel, with a 99% renewal rate in Q4 2023. Additionally, the new AI products achieved unprecedented success in their first quarter, setting a new record for the company’s product launches.

For FY 2024, analysts foresee a 15.8% increase in annual revenue, reaching $10.899 billion. However, they also expect earnings to be $1.215 billion for FY 2024, a decline from the $1.713 billion earned in FY 2023. In terms of subscription revenue, guidance is set at $10.57 billion, indicating a 21.7% increase and surpassing expectations by $70 million. The notable surge in revenue indicates rising demand among businesses for workflow automation software, which aims to enhance productivity.

On a brighter note, the company’s adjusted earnings per share hit $3.11 in Q4 2023, marking a 36% increase from the previous year and surpassing the consensus by 12%. Analysts predict adjusted earnings per share for Q1 2024 to be $3.15 per share. Adjusted EPS is often regarded as a more reliable indicator for future earnings expectations than non-adjusted EPS, as it offers a clearer perspective on a company’s operational performance.

The forecast for ServiceNow’s 2024 free cash flow also remains strong, rising from $2.704 billion in 2023 to $3.38 billion in 2024. This significant growth in free cash flow, coupled with the share buyback program initiated last May, underscores the company’s commitment to enhancing shareholder value.

NOW is a Strong Buy, According to Analysts

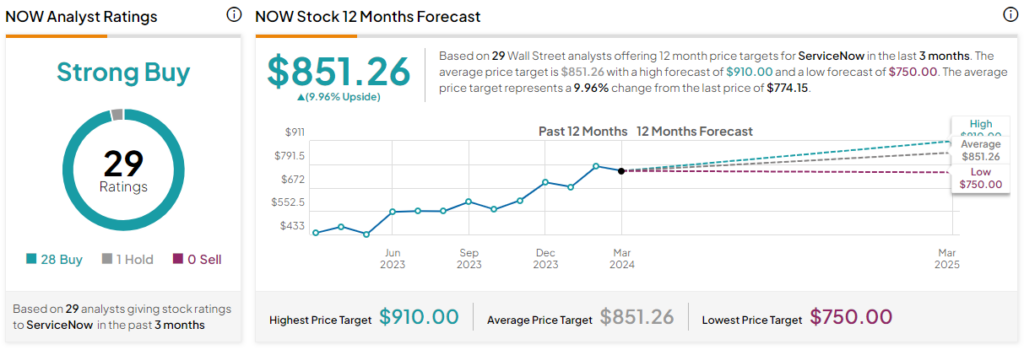

On TipRanks, NOW is currently rated as a Strong Buy based on 28 Buys and one Hold rating given in the past three months. The average NOW stock price target is set at $851.26, implying 10% upside from its last price. These analyst price targets vary, ranging from a low of $750.00 per share to a high of $910.00 per share.

The Takeaway

ServiceNow’s steady stock price climb reflects investors’ positive sentiment about NOW’s revenue and growth prospects. ServiceNow is reaping significant benefits from the growing belief that AI-based workflow software is essential for enhancing productivity. Couple that view with strong revenue growth and a strong cash flow base, and it’s clear why so many analysts consider ServiceNow a strong buy. Despite its high P/E ratio, I’m bullish on the stock.