Shares in ServiceNow (NOW) rose 2.3% higher in Wednesday’s after-hours trading after the IT cloud company reported both a top and bottom line beat despite elevated expectations.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Specifically, Q3 Non-GAAP EPS of $1.21 beat Street estimates by $0.18 while GAAP EPS of $0.06 also topped the consensus by $0.04. Revenue of $1.14B surged 26.8% year-over-year and came out $30M above consensus.

For the quarter NOW delivered an impressive non-GAAP operating margin of 26% vs consensus at 22.3% and guidance of 22%.

ServiceNow also reported 41 transactions over $1 million in net new annual contract value in Q3 2020, with 1,012 total customers with over $1 million in annual contract value.

“Our outstanding Q3 performance beat expectations across the board and we are raising our full-year guidance,” cheered ServiceNow CEO Bill McDermott. “COVID is redefining the future of work, accelerating digital transformation and amplifying the need to unify systems, silos, and processes into holistic enterprise workflows. ServiceNow is the platform for digital business.”

Looking to FY20 guidance, management raised the outlook across top-line and profitability metrics. Management raised subscription billings to $4.790B at midpoint, up 27% year-over-year, from 23.5% previously.

As for 4Q20 guidance, subscription revenue of $1.158B came in at the midpoint, 2.7% above the consensus.

Following the earnings report, RBC Capital’s Alex Zukin reiterated his NOW buy rating and bullish $600 price target (24% upside potential).

“NOW had a strong 3Q20 earnings report, highlighted by accelerating net new ACV growth, 30%+ cRPO growth, and beats across guided metrics. We believe the company is increasingly well positioned to capitalize on post-COVID customer initiatives” the analyst commented.

According to Zukin: “Management’s positive commentary on the 4Q pipeline aligns with our partner checks coming into the quarter while the company is seeing greater sales efficiency and a better pipeline coverage ratio going into next year than this time last year.” (See NOW stock analysis on TipRanks)

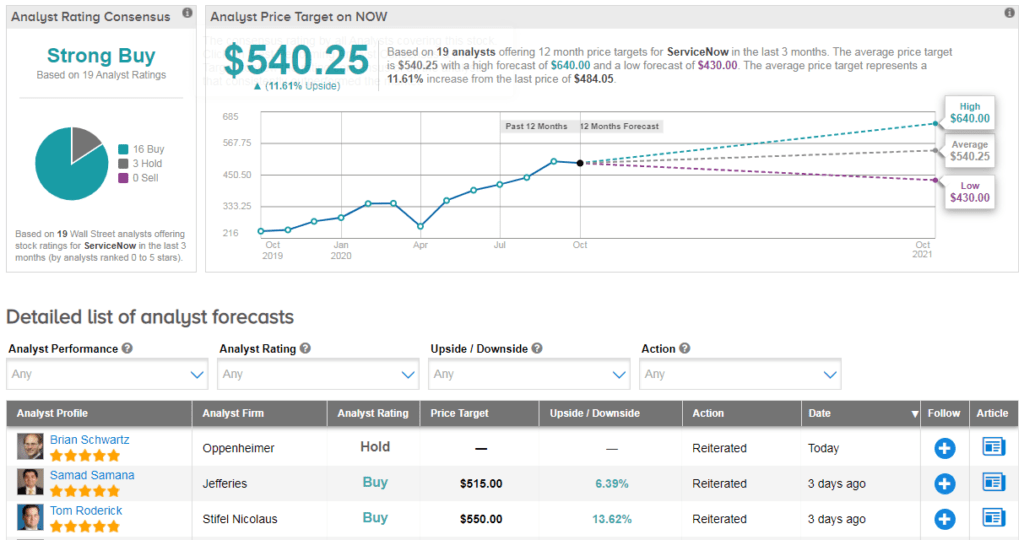

Overall, NOW boasts a Strong Buy analyst consensus with 16 buy ratings vs just 3 hold rating. Meanwhile the average analyst price target indicates 12% upside potential lies ahead, with shares already up over 70% year-to-date.

Related News:

Boeing Posts Quarterly Loss As Air Travel Halt Dents Sales; Shares Dip

Amazon Hires 100,000 Seasonal Workers Ahead Of Peak Holiday Period

Fiverr Surges In Pre-Market On Earnings, Revenue Beat