When insiders buy stock, it’s generally a good sign. While insiders might sell stock for any of a number of reasons, they generally buy stock believing that it will improve in value. Insurance broker SelectQuote (NYSE:SLQT) insiders did just that, sending shares up over 40% at the time of writing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Multiple insiders contributed to the massive stock buy-up, which ended up with insiders picking up around $1.2 million worth of shares in a comparatively short time span. Donald Hawks, a director with SelectQuote, purchased around $115,700 worth of stock by himself. Another SelectQuote director, Raymond Weldon, picked up close to $120,000 in shares.

SelectQuote’s CEO was also in on the buying, as was the company president. But the biggest purchase went to another director, Thomas Grant, who picked up $544,000 worth of shares, nearly half the buy-up total by himself. This comes despite the fact that just under a week ago, SelectQuote said it expects a net loss between $55 million and $73 million in Fiscal Year 2023.

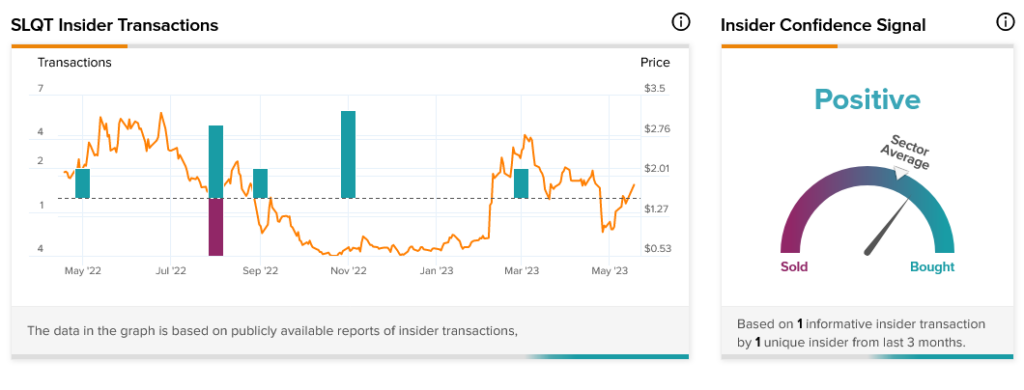

The latest buy was huge, but it’s actually not a recent thing. Taking a look at insider trading at SelectQuote shows that they have been buying for quite some time, thus, tipping overall insider confidence to “Positive.”