Shares of cloud-security solutions company Datto Holding Corp. (NYSE: MSP) jumped more than 20% at the close on Monday. The surge in price followed the software maker’s announcement that it inked a cash deal with IT management and security software firm Kaseya to be acquired for $6.2 billion, funded by Insight Partners. Investments from TPG Capital, Sixth Street Partners, and Singapore state investor Temasek will also support the deal.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Remarkably, 70% of Datto’s shareholders have already approved the deal.

Terms of the Deal

Per the terms of the agreement, Kaseya will pay $35.50 in cash for each share of Datto. The price tag represents a 52% premium to Datto’s stock price of $23.37 as of March 16, and a 48% premium to the unaffected 30-day volume-weighted average price for the period ended March 16, 2022.

The transaction, pending regulatory approvals, is expected to close in the second half of 2022. After closure, shares of Datto will not trade on the New York Stock Exchange, as it will become a private company. Nevertheless, till the finalization of the agreement, both companies will conduct their operations independently.

Official Comments

Encouragingly, Datto CEO Tim Weller said, “Datto has always been committed to creating world-class technology for small to medium-sized businesses (SMBs) and delivering it through our global network of managed service providers (MSPs) to align our growth with the channel. Combining with Kaseya brings together a broader array of technology products to create additional opportunities for MSPs.”

Furthermore, through the acquisition, Kaseya’s customers will be benefitted from more innovative and integrated solutions globally.

Wall Street’s Take

Following the news, Needham analyst Mike Cikos downgraded Datto to a Hold from a Buy and did not assign a price target.

Cikos said, “We see Datto’s take-private as supportive of valuation for N-able which currently trades at 6.3x and 5.4x our respective CY22 and CY23 Sales estimates.”

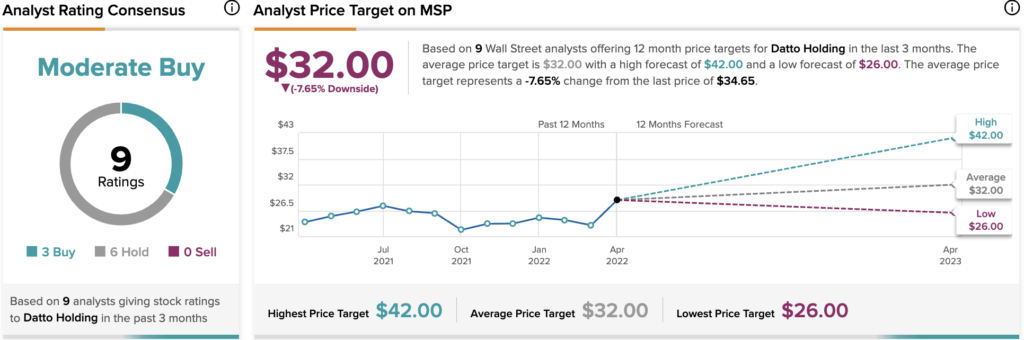

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on three Buys and six Holds. The average Datto price target of $32 implies a 7.65% downside potential. Shares have gained 41.72% over the past year.

Concluding Remarks

Many analysts anticipate a higher level of enterprise spending on cyber security and cloud-solutions, particularly as concerns of threats emanating from Russia materialize into reality. Keseya’s acquisition of Datto represents yet another chapter in the evolving saga of the highly competitive and rapidly expanding cybersecurity industry in 2022.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

CrowdStrike Secures Another Milestone; Shares Rally

Novavax Receives Authorization to Inject COVID-19 Vaccine in Thailand

Tesla CEO Elon Musk Turns Down Twitter Board