With the spot price of gold hitting new all-time highs, there has been quite a bit of investor interest in gold, gold ETFs, mining stocks, and companies like Sandstorm Gold (NYSE:SAND), a gold royalty and streaming company. The stock has increased close to 20% in the past month due to investor enthusiasm.

Sandstorm Gold has been languishing in negative return territory for most of the past three years. This recent spike in interest may be a much-needed catalyst for the market to revisit the positive characteristics of the company, as well as provide an opportunity for investors looking for a value play on gold.

Leveraged Gold

Sandstorm Gold is a gold royalty and streaming company that earns income by purchasing royalties on mining operations globally. Instead of operating mines directly, Sandstorm provides upfront payments in exchange for future revenue or gold production, resulting in a diversified portfolio that delivers stable cash flows and considerable growth potential.

This strategy has enabled the firm to build a portfolio of over 250 royalty interests on mining projects worldwide, including operations across North America, South America, Africa, and Asia. Looking forward, Sandstorm holds rights to schedule gold production of approximately 75,000 to 90,000 gold equivalent ounces over the next year. This figure is expected to grow to over 125,000 gold equivalent ounces annually within the next five years.

Financial Results & Outlook

Sandstorm recently reported solid earnings for the fourth quarter and fiscal year, with positive growth in both revenue and earnings per share. The company reported revenues of $44.5 million, representing a 15.7% increase compared to the same quarter in the previous year. Earnings have also improved significantly, with a net income of $24.5 million, for an EPS of $0.08 per share, improving from a net loss of $2.1 million, or -$0.01 per share, in the same period last year.

2023 marked a record year in annual revenue for the company, reaching $179.6 million, up from the $148.7 million reported in 2022.

The company has announced a quarterly cash dividend of $0.01 per common share, payable on April 26 to shareholders on record by April 16. Based on the current payout and share price, this provides shareholders with an attractive dividend yield of approximately 1.1%.

What is the Price Target for SAND Stock?

With the recently strong upward move in the share price, the stock is trading towards the upper end of its 52-week price range of $3.96-$6.31. It continues to show positive price momentum, trading above the 20-day (4.85) and 50-day (4.71) moving averages. The company appears to be relatively undervalued, with an EV/FCF of 15.72 versus the Gold industry average of 35.03.

Analysts following the company have been mostly bullish on the stock. For example, H.C. Wainwright analyst Heiko Ihle issued a Buy recommendation with a $10.75 price target, citing the robustness of its royalty and streaming business model. Indeed, since Ihle gave his Buy recommendation on January 11, the stock has risen 14%.

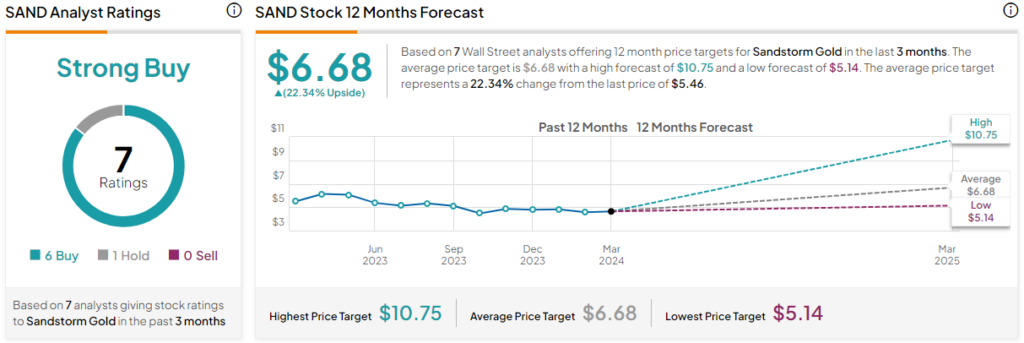

Sandstorm Gold is rated a Strong Buy based on the seven Wall Street analysts’ recommendations and 12-month price targets issued in the past three months. The average price target for SAND stock is $6.68, which represents a 22.34% upside from current levels.

SAND in Summary

With the price of gold showing no signs of slowing down, Sandstorm’s unique position as a gold royalty and streaming company comes into sharp focus. Benefiting from the rising gold prices without suffering the costs of mining operations, the company offers a leveraged play in the gold sector. Furthermore, SAND stock’s current undervaluation relative to the gold industry and its projected production growth over the next five years underscores its potential upside. It could therefore present a compelling investment opportunity in the gold market.