Enterprise software giant Salesforce (NYSE:CRM) – which specializes in consumer relationship management solutions – has rewarded longtime shareholders with robust returns. However, recent market dynamics suggest that the company is no longer a growth machine. Therefore, the company picked a good time to pivot to passive income via dividends. I am bullish on CRM stock as the leadership team moves into a new phase for the business.

Strong Earnings and a First-Ever Dividend Boost CRM Stock

Last week, Salesforce reported upbeat results for the fiscal fourth quarter, according to TipRanks reporter Radhika Saraogi. Higher demand for the company’s cloud services lifted its adjusted earnings per share to $2.29, outpacing Wall Street’s estimate of $2.27 per share. Further, the print represented a 36.3% rise from the year-ago quarter.

On a similarly positive note, Salesforce generated revenue of $9.29 billion, representing an increase of about 11% year-over-year. Further, this tally beat the consensus target of $9.22 billion. In terms of individual segments, the company’s Subscription and support sales increased 12% against the prior-year quarter to $8.75 billion.

However, not everything went smoothly. For example, Salesforce’s Professional services and other revenues dipped to $539 million, a loss of 9% year-over-year. Also, management anticipates that revenue for the full Fiscal Year 2025 will land between $37.7 billion and $38 billion. However, this figure slipped below the consensus estimate of $38.7 billion.

Following the earnings disclosure, CRM stock slipped in after-hours trading. However, it ended last week on a high, returning over 7%. One of the top catalysts centered on Salesforce’s first-ever dividend. Thanks to its strong cash position, management initiated a common stock dividend of $0.40 per share. The dividend will be payable on April 11 to shareholders of record as of March 14.

Fundamentally, the leadership team is likely making the right move. For Fiscal 2024, Salesforce posted sales of $34.86 billion. Over the past five years, the company has seen its revenue expand at a compound annual growth rate (CAGR) of 15.34%. However, in the five-year period between 2016 through the end of 2020, Salesforce’s top line expanded at a CAGR of 20.6%.

As stated earlier, CRM stock no longer represents a growth-at-any-cost type of investment. It’s wise for management to go the dividend route to attract new investors.

Options Market Points to a Slow-and-Steady Environment

Another factor to keep in mind is the industry itself. As Grand View Research noted, the global customer relationship management market size reached a valuation of $65.59 billion last year. Analysts project that the sector will expand at a CAGR of 13.9% from 2024 to 2030. At the forecast’s culmination point, the industry could be worth $163.16 billion.

Certainly, one would expect CRM stock to benefit from this burgeoning ecosystem. After all, Salesforce represents one of the leaders in the space. However, in the trailing three years since the conclusion of Fiscal Year 2024, Salesforce’s revenue expanded at a modest CAGR of 9.61%.

In other words, the company is no longer leading its industry. New competitors are moving in, attracting speculation dollars. To keep investors interested, management had to do something. That something was to reward shareholders with dividends.

Further, the options market appears to “incentivize” the company’s new direction. Looking at the options flow data for CRM stock – which filters for big block transactions likely placed by institutions – it appears that major entities placed volatility “insurance” wagers on Salesforce. Specifically, they acquired put options featuring strike prices from $230 to $300, all with an expiration date of June 21.

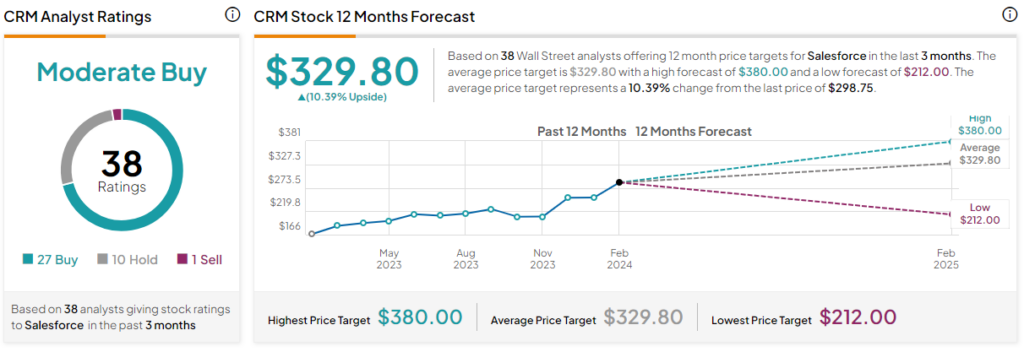

On the flip side, the major bullish players bought call options, many ranging from a strike price of $330 to $400. However, a notable difference was that the optimists tended to acquire long-expiry calls. These derivatives more or less match the pace implied by analysts’ projected price targets (as shown in the image below).

In contrast, the insurance wagers are near-expiry puts. It’s possible that traders are worried about near-term volatility unwinding the good work that CRM stock performed recently. However, once the coast is clear, investors may pop back in more decisively on the bullish side of the spectrum.

A Patient Approach Might be Best

While most analysts are optimistic about CRM stock, the lowest price target sits at $212. On January 8, Bernstein’s Mark Moerdler issued the red-stained price forecast, noting that Salesforce is a Sell. The target implies 29% downside from Friday’s close.

It’s an ugly prognostication, and at least one major trader believes that it’s possible to drop to that level. That’s based on the unusually high volume hitting the Jun 21 ’24 230.00 Put. It’s not surprising that some traders are fearful, given the rags-or-riches nature of the tech environment right now.

So, concerned investors may want to see what the next few sessions bring before committing to a significant move.

Is CRM Stock a Buy, According to Analysts?

Turning to Wall Street, CRM stock has a Moderate Buy consensus rating based on 27 Buys, 10 Holds, and one Sell rating. The average CRM stock price target is $329.80, implying 10.4% upside potential.

The Takeaway: CRM Stock Adjusted to New Realities

In a prior iteration, CRM stock offered investors robust growth opportunities. However, those days are quickly fading, and Salesforce needed to do something to keep investors interested in the business. I believe that initiating dividend payments was the right call, given where the company is now. Best of all, the market appears to agree with the decision.