Surging energy prices after Russia’s shutdown of the Nordstream gas pipeline could lead to factory closures across Europe, as prices hit heavy industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Wall Street Journal warned of a possible new era of de-industrialisation in the wake of surging and volatile prices – and the Financial Times says companies are taking measures such as hedging energy bills, shutting down furnaces and diversifying energy use.

In Britain, heavy industry employs 210,000 people, contributing £29 billion to the economy and accounting for 16% of Britain’s energy use.

Speaking to the Wall Street Journal,. Milan Veselý of Slovalco in Slovakia, says he is winding down primary-metals production and dismissing 300 out of 450 workers.

He said, “This is probably the end of metal production in Europe. The volatility of the price of electricity these days it’s crazy. This is the way we are actually killing industry.”

Wave of de-industrialisation?

Miles Roberts, CEO of FTSE 100-listed packaging company DS Smith (GB:SMDS), told the Financial Times that energy rationing is expected across Europe.

He said, “We are expecting there to be rationing across Europe, that’s what we’re preparing for. It may not happen, but we have to plan for that now.”

The company is also reducing consumption and diversifying energy use.

Liz Truss to the rescue?

In Britain at least, there is some hope at least in the short term, with incoming Prime Minister Liz Truss offering businesses a guarantee ‘equivalent’ to that offered to consumers, whose bills have been limited to a projected £2,500 per year.

Businesses have been offered protection for six months, with further details to be announced.

Speaking in the House of Commons, Truss said,: “The business secretary will work with businesses to ensure those most in need will get support. His report will be collated in three months, giving business clarity.”

Industry leaders have called for more clarity on the plans.

View from the City

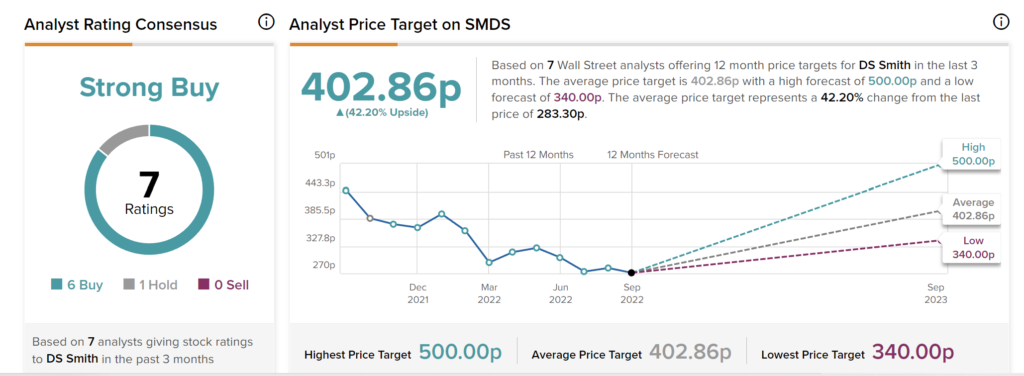

According to TipRanks’ analyst rating consensus, DS Smith stock is a Strong Buy. This is based on ratings from seven analysts, out of which six are Buy and one is Hold.

The average price target is 402.86p, which shows an increase of 42.50% on the current price. The analyst price target has a high and low forecast of 500p and 340p, respectively.

Conclusion

Industry leaders need clarity from Liz Truss on how much support will be available and to whom over the coming months and years.