Global specialty coatings, sealants, building materials and related services provider RPM International (RPM) has reported strong results for the fiscal fourth quarter ended May 31. The company runs 124 production units across the world and sells its products in 170 regions. Its key brands include Dryvit, Day-Glo, Tremco, Carboline, Stonhard, Legend Brands, Varathane, Zinsser, DAP and Rust-Oleum, among others.

Adjusted earnings per share (EPS) increased 13.3% year-over-year to $1.28, just above the Street’s estimate of $1.27. Quarterly sales rose 19.6% year-over-year to $1.74 billion, surpassing analysts’ expectations of $1.68 billion. (See RPM stock chart on TipRanks)

Construction Products Group net sales grew 33.2% to a record $629.4 million; net sales of Performance Coatings Group climbed 20.5% to $283.3 million; Consumer Group net sales surged 2% to $628.9 million; and net sales of the Specialty Products Group jumped nearly 50% to $202.8 million.

Sharing his forecast for the first quarter of Fiscal Year 2022, the Chairman and CEO of RPM, Frank C. Sullivan, said, “We expect consolidated sales to increase in the low- to mid-single digits compared to the Fiscal 2021 first quarter. We anticipate our Construction Products Group and Performance Coatings Group to experience sales increases in the high-single or low-double digits. The Specialty Products Group is expected to generate double-digit sales increases. Sales in our Consumer Group are expected to decline double digits…We remain committed to achieving our long-term goal of a 16% EBIT (earnings before interest and taxes) margin.”

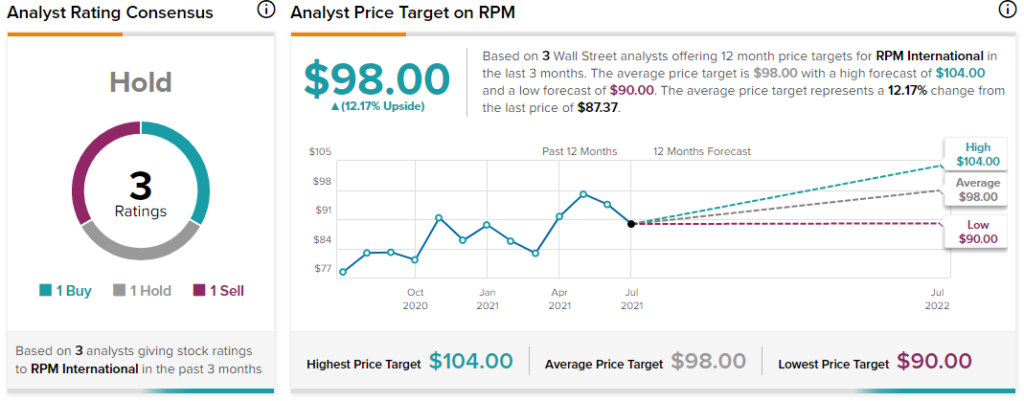

Last month, J.P. Morgan analyst Jeffrey Zekauskas downgraded the stock to Sell from Neutral with a price target of $90 (3% upside potential). The analyst said, “We view RPM as a company with relative performance risk rather than absolute performance risk. RPM is likely to contend with raw material, packaging, and logistics cost inflation in the upcoming two quarters, pressuring its gross margins. Announced price increases will take some time to catch up with cost inflation.”

Overall, the stock has a Hold consensus based on 1 Buy, 1 Hold and 1 Sell. The average RPM International price target of $98 implies 12.2% upside potential to current levels. Shares of the company have gained nearly 8% over the past year.

Related News:

Tesla Reports Record Quarterly Results; Shares Rise 1% After-Hours

OTIS Hits All-Time High on Strong Q2 Results; Raises Guidance

Lockheed Martin Delivers Mixed Q2 Results; Shares Fall