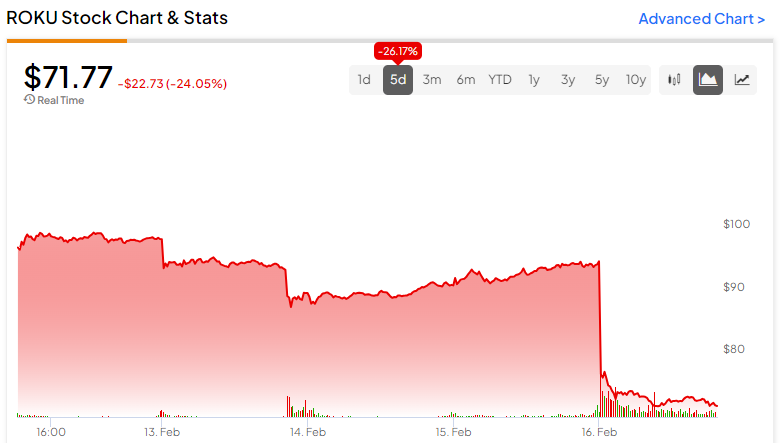

Even as Roku (NASDAQ:ROKU) stock tumbles today, level-headed investors can stand by the company for potential long-term gains. There’s a lot going on with Roku now, and some people are alarmed. Yet, I am bullish on ROKU stock and would even consider buying the dip on this one.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Roku is a well-known provider of streaming content equipment, including televisions, streaming players, and audio devices. Furthermore, Roku claims to be the “leading TV streaming platform in the U.S. and Mexico by hours streamed.”

ROKU stock has wobbled all over the place during the past year, and today, it’s down 24%. It takes guts to dive into a stock during times of high volatility. However, after discovering why the market is suddenly turning against Roku, you might decide that it’s an overreaction and a great buying opportunity.

Roku and the Walmart Deal Jitters

One of the reasons Roku became so well-known in the first place is because the company’s products are sold in the stores of retail giant Walmart (NYSE:WMT). That’s a huge win for Roku, as in the world of U.S. brick-and-mortar retail store chains, the holy grail is to get your products sold in Walmart.

However, Walmart also sells similar television and streaming products from a competing company, Vizio (NYSE:VZIO). There’s enough room in Walmart for both Roku’s and Vizio’s products to be strong sellers. Still, if Walmart favors Vizio’s products, this could pose a problem for Roku.

Thus, ROKU stock fell 10% a few days ago due to a report that Walmart is in talks to buy Vizio. More recently, The Wall Street Journal reported that Walmart’s management is “mum” (i.e., silent) on the topic of Walmart-Vizio talks.

Even if Walmart ends up buying out Vizio, this won’t necessarily be all bad news for Roku. For one thing, it doesn’t automatically mean that Walmart will stop selling Roku’s products. Furthermore, KeyBanc analyst Justin Patterson anticipates that Walmart being in control of Vizio might provide a welcome boost for Roku, offering “some valuation support for Roku’s installed base.”

Meanwhile, Matt Farrell of Piper Sandler is looking for Roku to lose ground if Walmart acquires Vizio. At the same time, however, other reports suggest that there would be little for Roku to worry about, as Vizio is a “fringe platform player” at best. All in all, I would assess that ROKU stock traders should monitor the situation but not obsess over Vizio as a competitor to Roku.

Roku Disappoints with Current-Quarter Guidance

In other news, Roku released its fourth-quarter 2023 financial and operational results after market close yesterday. Amazingly, Roku marked a milestone of 80 million active accounts as well as more than 100 billion hours streamed on Roku’s platform in 2023. Plus, according to the press release, “In the U.S., Roku’s active account base is now bigger than the subscribers of the six largest traditional pay-TV providers” combined.

This supports my belief that a Walmart-Vizio deal wouldn’t be the end of the world for Roku. Still, something is causing today’s traders to dump ROKU stock. Most likely, it’s not Roku’s fourth-quarter results.

Roku reported total revenue of $984.42 million, up 14% year-over-year and ahead of Wall Street’s call for $963.67 million. So far, so good. Turning to the bottom-line results, Roku’s Q4-2023 loss of $0.55 per share fell right in line with what analysts had expected.

However, it appears that stock traders aren’t happy with Roku’s current-quarter guidance. Specifically, Roku expects to report a Q1-2024 gross profit of $370 million, slightly below the consensus estimate of $373.4 million.

On the other hand, Roku anticipates current-quarter net revenue of $850 million, which is higher than Wall Street’s consensus estimate of $834.1 million. In other words, it seems like a strange reaction for today’s traders to panic sell ROKU stock. I suspect that this is just an extension of the market’s jitters about the potential Walmart-Vizio deal.

Is ROKU Stock a Buy, According to Analysts?

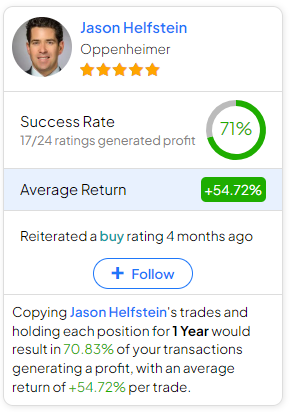

On TipRanks, ROKU comes in as a Hold based on five Buys, seven Holds, and two Sell ratings assigned by analysts in the past three months. The average Roku stock price target is $91.83, implying 27.8% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell ROKU stock, the most profitable analyst covering the stock (on a one-year timeframe) is Jason Helfstein of Oppenheimer, with an average return of 54.72% per rating and a 71% success rate. Click on the image below to learn more.

Conclusion: Should You Consider ROKU Stock?

Roku will still be a streaming market standout even if Walmart buys out Vizio. Plus, Roku’s fourth-quarter results were fine, and the company’s first-quarter guidance isn’t terrible.

The point is that the market is in overreaction mode and has simply decided to put Roku in the doghouse right now. I tend to believe that this overwhelmingly negative sentiment against Roku will pass. Consequently, I am bullish on ROKU stock and would consider it for a share position today.