Roku (NASDAQ:ROKU), one of the biggest names in set-top box hardware for streaming, is in a freefall in Friday afternoon’s trading, down nearly 10%. This comes after an earnings report that featured decent numbers and some welcome second-quarter guidance. So, why did the stock that started a fall in after-hours trading continue right on falling into and through Friday afternoon’s trading? The answer seems to come back to rising FAST competition.

FAST, or Free Ad-Supported Television, is the name for a growing body of online video channels that don’t charge a membership fee but rather show ads to monetize their content. It’s essentially the online equivalent of the model that broadcast and later cable television used for years. It also, in many cases, uses a lot of their old content, too, though not in every case.

Examples of FAST platforms include Pluto TV, Tubi, and even The Roku Channel. But that’s also part of the problem, Roku revealed: there’s a lot of competition in the FAST channels space, and that might make getting and keeping viewers a tall order.

A Wide Variety of Content Is Emerging on FAST Platforms

Indeed, a wide, wide variety of content is emerging on FAST platforms. PBS recently rolled out PBS Retro, which seeks to answer the question “Why can’t I watch old episodes of ‘Mister Rogers’ Neighborhood’ anywhere online?” Now, you can, along with a host of other programs from the 1970s through 1990s. Meanwhile, Hemisphere Media brought out WAPA+, which includes programming from the leading television network in Puerto Rico.

And, of course, Roku itself has plenty of original content; it was, after all, behind “Weird: The Al Yankovic Story” back in January, along with pretty much everything the short-lived Quibi channel released. But any time there are this many players in a market, it’s a safe bet that something will be overlooked. Roku is deeply afraid that it will be the overlooked one, and not without cause.

Is Boeing Stock a Buy, Sell, or Hold?

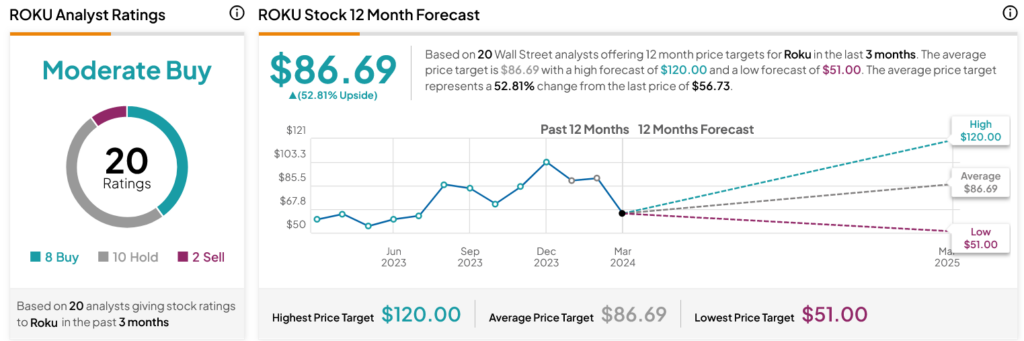

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ROKU stock based on eight Buys, 10 Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 0.54% loss in its share price over the past year, the average ROKU price target of $86.69 per share implies 52.81% upside potential.