Shares of Robinhood Markets (NASDAQ:HOOD) fell nearly 6% in extended trading on August 2, despite posting a surprise profit in its second-quarter Fiscal 2023 results. A one-million-user decline in the number of HOOD’s monthly active users (MAUs) may be the cause of the fall in the stock price. Robinhood said its MAUs in Q2 were 10.8 million. Robinhood Markets is a trading platform for stocks and cryptocurrency.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On the brighter side, Robinhood’s assets under custody (AUC) grew 13% sequentially to $89 billion in Q2, and net cumulative funded accounts rose 70,000 to 23.2 million.

Details of Robinhood’s Q2 Results

Robinhood posted its first-ever profitable quarter, with diluted earnings of $0.03 per share. Analysts had expected HOOD to post a loss of $0.01 per share. Similarly, total net revenues grew 53% year-over-year to $486 million, also beating the Wall Street consensus of $472.94 million. Q2 revenue was also up 10% sequentially, thanks to a 13% year-over-year increase in Robinhood’s net interest revenue to $234 million.

On the other hand, transaction revenue declined 7% sequentially to $193 million. The decline was primarily due to an 18% fall in cryptocurrency revenue, a 7% fall in Equity revenue, and a 5% fall in Options revenue. Notably, Robinhood’s average revenue per user (ARPU) grew to $84 in Q2, up from $77 in Q1FY23.

Looking ahead, the fintech company sees its full-year Fiscal 2023 operating expenses falling between $2.33 and $2.41 billion.

Is Robinhood a Buy, Sell, or Hold, as per Analysts?

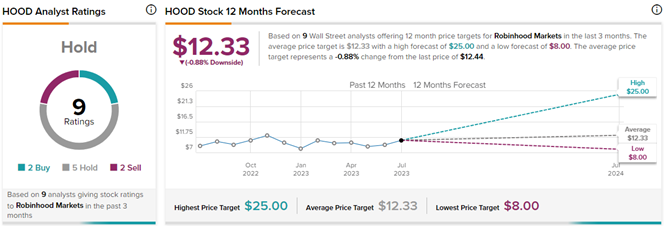

Wall Street remains split about HOOD’s stock trajectory. Following, Robinhood’s Q2 print, analyst Dan Dolev of Mizuho Securities set a price target of $14 (12.5% upside) on the stock and reiterated a Buy rating.

Also, JMP Securities analyst Devin Ryan reiterated his Buy rating and $25 price target, which implies a whopping 100% upside potential.

On the contrary, Goldman Sachs analyst Will Nance reiterated his Hold rating on HOOD stock while raising the price target to $11 (11.6% downside potential) from $10.

Overall, Robinhood stock has a Hold consensus rating. This is based on two Buys, five Holds, and two Sell ratings. On TipRanks, the average Robinhood Markets price target of $12.33 implies that shares are almost fully valued at current levels. Meanwhile, HOOD stock has gained 20.7% so far this year.