RLX Technology, a Chinese branded e-vapor company, posted a better-than-expected 4Q profit, driven by strong revenues. Shares declined 1.1% in Friday’s extended trading session after closing almost 1% lower on the day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

RLX Technology’s (RLX) 4Q earnings came in at $0.05 (RMB0.292) per share, versus the consensus estimate of $0.04 per share. The company reported a loss of RMB0.029 per share in the same quarter last year.

Net revenues of $248 million (RMB1,618.5 million) more than tripled from the year-ago period together with gross profits, while total operating expenses increased significantly. (See RLX Technology stock analysis on TipRanks)

RLX Technology CEO Ms. Ying (Kate) Wang said, “Looking forward, we plan to further solidify our leadership as we endeavor to continue investment in scientific research, enhance our technology and product development, strengthen our distribution and retail network, bolster supply chain and production capabilities, and extend our global capabilities. These strategic initiatives are designed to support our growth over the long-term.”

For the first quarter of 2021, the company projects net revenues to be more than RMB2.3 billion, while non-GAAP net income is expected to exceed RMB590 million.

On March 12, Citigroup analyst Lydia Ling initiated coverage of the stock with a Buy rating and a price target of $20 (119.3% upside potential).

According to Ling, RLX is the dominant player in the e-vapor space, with China’s e-vapor industry having user penetration of only 1.2%.

With strong product development and distribution capabilities, the analyst believes RLX is “well poised to lead the industry, even as competition intensifies.”

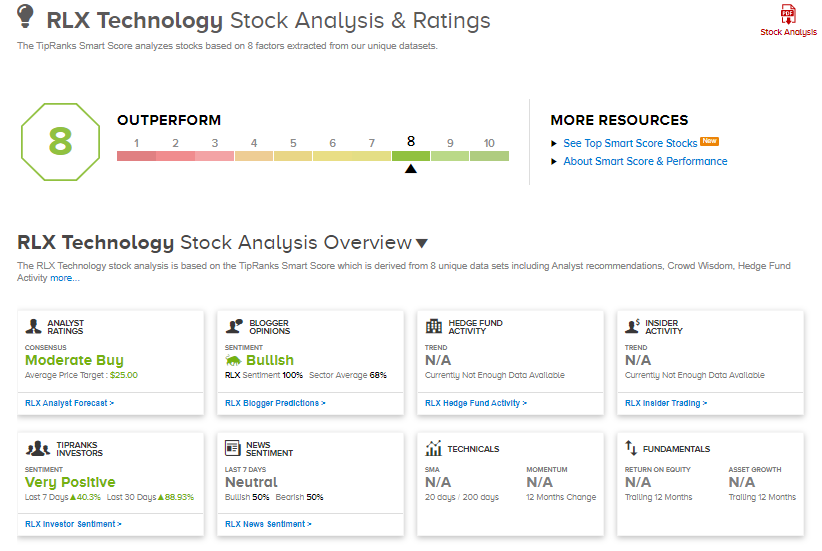

The consensus rating among analysts is a Moderate Buy based on 2 Buys. The average analyst price target stands at $25 and implies upside potential of 174% to current levels over the next 12 months.

RLX Technology scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

KBR Provides Long-Term Financial Targets; Shares Pop 13%

Bioventus’ 4Q Results Outperform Analysts’ Expectations

Satsuma Posts Wider-Than-Feared Quarterly Loss