Electric vehicle maker Rivian Automotive (RIVN) has reported financial results that blew past Wall Street forecasts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The California-based company announced a loss per share of -$0.41, which was much better than a loss of -$0.76 expected among analysts. The automaker said its revenue for the year’s first quarter totaled $1.24 billion, which topped the $1.01 billion that had been anticipated on Wall Street.

Management said that they delivered 8,640 electric vehicles during the first quarter. That was down nearly 40% from 14,183 cars delivered in the previous fourth quarter. For all of this year, Rivian now expects to deliver 40,000 to 46,000 electric vehicles. That guidance is down from a previous range of 46,000 to 51,000 electric vehicle deliveries in 2025.

Rivian Automotive’s net income. Source: Main Street Data

‘Significant Uncertainty’

“The current global economic landscape presents significant uncertainty, particularly regarding evolving trade regulation, policies, tariffs, and the overall impact these items may have on consumer sentiment and demand,” said the company in announcing its lowered guidance for the year.

Rivian said it ended this year’s first quarter with $8.5 billion in liquidity, including $7.2 billion of cash on hand. The company’s Q1 results were helped by an increase in sales of automotive regulatory credits that totaled $157 million, as well as an increase in software and services revenues of $318 million.

RIVN stock has risen 1.50% this year.

Is RIVN Stock a Buy?

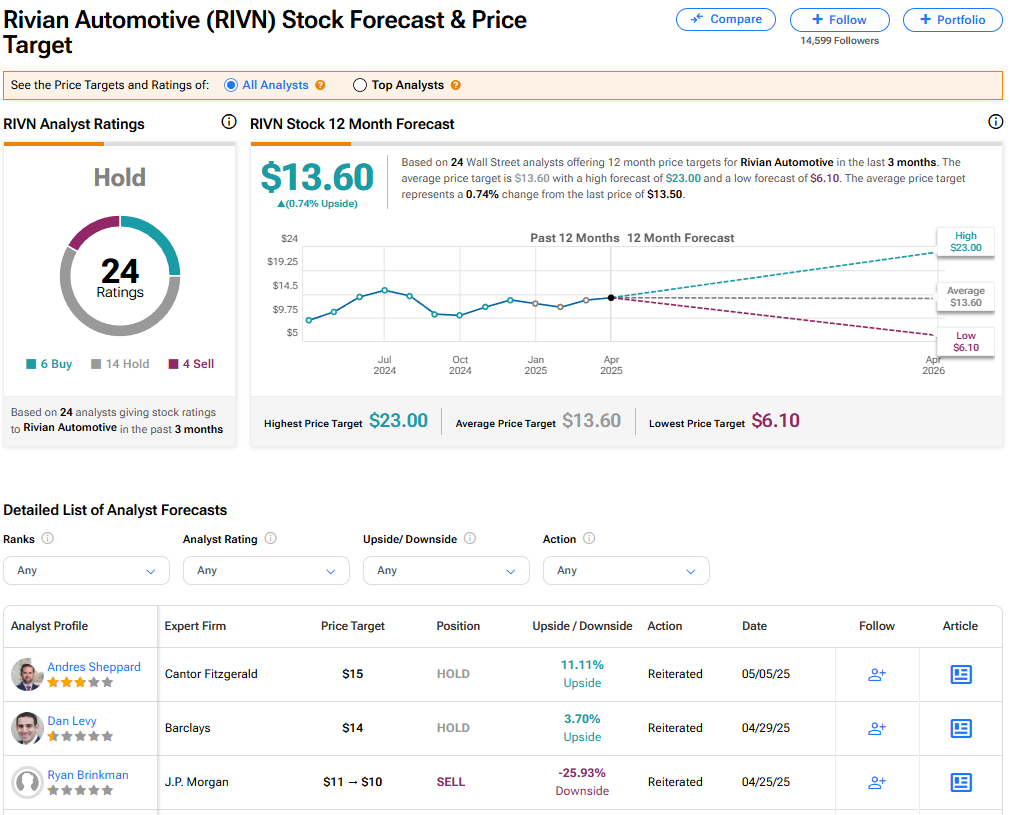

The stock of Rivian Automotive has a consensus Hold rating among 24 Wall Street analysts. That rating is based on six Buy, 14 Hold, and four Sell recommendations issued in the last three months. The average RIVN price target of $13.60 implies 0.74% upside from current levels. These ratings are likely to change after the company’s latest financial results.