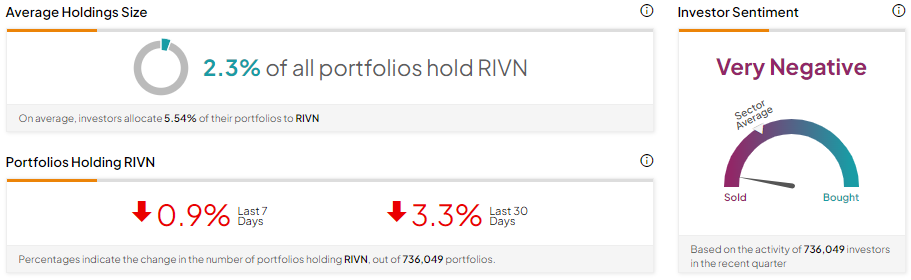

Rivian Automotive (NASDAQ:RIVN) stock has dropped nearly 58% year-to-date. Also, individual investors have a Very Negative view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock decreased by 3.3%. This suggests these investors are lowering their exposure to RIVN amid industry-wide weakness in EV demand.

Overall, among the 736,049 portfolios monitored by TipRanks, 2.3% have invested in RIVN stock.

Is Rivian Stock a Buy or Sell?

Rivian stock has lost substantial value so far this year, reflecting softness in the EV market. Moreover, heightened price competition is putting pressure on margins. While near-term demand weakness poses challenges and could restrict the recovery, the company’s production plant upgrade will remove a significant amount of cost from its vehicles. This will likely cushion its margins and support profitability.

Moreover, the electric vehicle (EV) maker maintained its 2024 production guidance of 57,000 vehicles. Further, it projects total deliveries to grow by low single digits this year, which is positive.

Wall Street analysts are cautiously optimistic about RIVN stock. With 10 Buys, eight Holds, and two Sells, Rivian stock has a Moderate Buy consensus rating. Analysts’ average price target on RIVN stock is $13.89, implying 39.60% upside potential.

Bottom Line

Though RIVN stock has a Very Negative signal from individual investors, Wall Street analysts remain somewhat optimistic about its prospects. Moreover, their price target suggests notable upside potential. These mixed data points suggest that investors should consider multiple factors while investing. Investors can leverage TipRanks’ Experts Center tools to gain insights and make informed investment decisions.