EV maker Rivian Automotive (NASDAQ:RIVN) is teaming up with Australia’s Mining Electric Vehicle Company (MEVCO) to provide electric vehicles for the mining, mining services, and mining equipment industries. The exclusive global partnership was announced just days before Rivian’s first-quarter results, coinciding with the company’s stock price hitting multi-year lows.

MEVCO is a leading provider of sustainable electric vehicle fleet solutions for mining. As part of the partnership, MEVCO will customize Rivian’s R1T pickup trucks to meet mining requirements and assist mines in setting up essential charging infrastructure.

Rivian Faces Dampened Investor Sentiment

For Rivian, the new partnership comes as the company’s share price languishes at multi-year lows. Rivian stock has cratered from as much as $172 in November 2021 to the present $8.64 level. Earlier this month, the automaker reported production of 13,980 vehicles and the delivery of 13,588 vehicles in Q1. For the full year, it reaffirmed expectations of producing 57,000 units. However, investor sentiment in the stock is running low as, sequentially, the numbers declined from roughly 17,500 units produced and 14,000 deliveries in the prior quarter.

Additionally, Rivian laid off nearly one percent of its workforce last week amid challenging times for the broader EV industry. This is the second round of layoffs at the company this year as it aims for a positive gross margin by the end of this year.

RIVN’s Upcoming Q1

Amid these challenges, Rivian’s first-quarter results on May 7 will be keenly watched. Analysts expect the company to post a net loss per share of $1.15 on revenue of $1.15 billion for the quarter. In the comparable year-ago period, Rivian’s net loss per share of $1.25 had come in narrower than expectations by a margin of $0.37.

What Is the Target Price for RIVN?

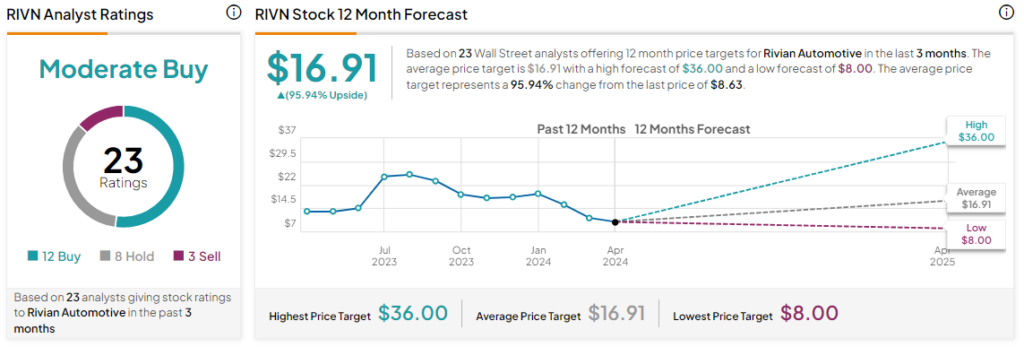

Overall, the Street has a Moderate Buy consensus rating on Rivian. Additionally, the average RIVN price target of $16.91 points to a massive 95.9% potential upside in the stock.

Read full Disclosure