It’s hard to believe that environmental reasons are the main factor for drivers purchasing vehicles from EV manufacturer Rivian Automotive (NASDAQ:RIVN). Rather, the cost savings – especially over the long run – of not having to fill up at the local gasoline station probably rank quite highly. So, when gas prices are rising, that should be a clear upside catalyst for RIVN stock. But look at the charts. That’s not the case at all. Therefore, I am bearish on Rivian.

RIVN Stock Should be Moving Higher

While it’s easy to blast EVs for their vulnerabilities – particularly in extreme weather conditions – it’s also fair to point out their many advantages over their combustion-powered counterparts. One major advantage is that EVs have fewer moving parts. Drivers of electric-powered cars can kiss oil changes and filling up at pricey petrol stations goodbye. With conditions moving in favor of EVs, RIVN stock should be moving higher.

After all, the latest Consumer Price Index (CPI) report showed that inflation came in hotter than expected. Of course, one of the main culprits was the rising cost of crude oil. With geopolitical flashpoints boiling over in multiple parts of the world, the cost of critical hydrocarbons will likely move higher. Surely, analysts and smart money investors understand this dynamic.

Despite this recognition, though, RIVN stock tumbled. Last week, the shares fell by over 10%. Critically, RIVN dropped below the psychologically important $10 level. Generally speaking, the market tends to move around whole round numbers, especially significant ones.

For RIVN stock, it doesn’t get much more significant than $10. Why? It’s the demarcation point between a single-digit price and a double-digit one.

On a fundamental note, U.S. credit card debt hit a record $1.13 trillion in February. Further, delinquency rates are rising, demonstrating that people are looking for savings wherever they can find them. With pumping gas representing a non-negotiable purchase for combustion-powered vehicle drivers, escaping this financial noose for an EV seems logical.

However, Rivian EVs are not cheap. Even the upcoming R2 – which is priced at a relatively reasonable $45,000 – will arrive in 2026. That’s a long time to wait when you need relief now.

Yet, even with ownership of combustion vehicles projected to become more expensive, EV investments are struggling. That’s not good news for RIVN stock.

Rivian Suffers from a Double Impact

In football, one of the worst types of collisions involves getting hit simultaneously on opposite ends. It’s a jarring experience that can leave offensive players injured on the field. Unfortunately, this analogy is apt for RIVN stock and its present market dynamics.

The first hit comes from the sector itself. With Tesla (NASDAQ:TSLA) starting a price war, the directive hurt pure-play EV enterprises. Further, Tesla’s disappointing results suggest that the company took its own medicine. Naturally, this circumstance will hurt RIVN stock because it clouds the underlying company’s pathway to profitability.

The second hit comes from legacy automakers, specifically Toyota (NYSE:TM). As multiple TipRanks reporters and contributors stated, the Japanese automaker has been killing it with global sales of its hybrid vehicles. Essentially, hybrids combine the best of both worlds. Drivers enjoy higher efficiencies (boosted mileage) while also benefiting from already-established infrastructure (gas stations).

Moving forward, hybrids could be the near-term future of mobility rather than pure-play EVs. Obviously, that’s a huge impediment to RIVN stock. What’s worse for Rivian in the immediate sense, Toyota is effectively stealing RIVN’s potential addressable market share.

Again, Rivian’s savior model – the aforementioned R2 – will arrive in 2026. That leaves two years for Toyota to soak up demand. And here’s the thing: people don’t buy cars every year. No, if a consumer buys a vehicle, a rival automaker will likely not be able to sell to that individual for at least three years, if not longer.

Also, here’s another thing that consumers are just realizing. According to CNBC, EVs have poor resale value. The average price of an EV fell 31.8% in the past year compared to 3.6% for combustion-powered vehicles.

To be fair, that’s not an exclusive problem for RIVN stock. However, it just compounds the troubles.

Valuation Adjustments Required

Ultimately, while the fundamentals may influence an investment decision, it’s the numbers that seal the deal. For RIVN stock, its numbers likely need to be adjusted in an unfavorable direction.

Long story short, investors are buying Rivian stock on the assumption that at some point, the company will be profitable. In that sense, analysts are projecting Fiscal 2024’s loss per share to land at $4.03. In the following year, the loss per share could be reduced to $2.53.

That’s an encouraging trend – if it’s credible. However, the headwinds of price wars and competitive pressures mean that Rivian must extend the anticipated path to profitability. That’s not a message investors want to hear, thus explaining in part the red ink in RIVN stock.

Is RIVN Stock a Buy, According to Analysts?

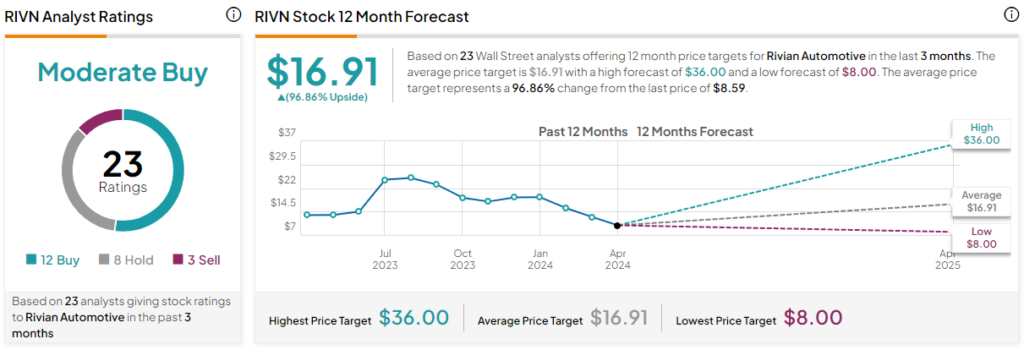

Turning to Wall Street, RIVN stock has a Moderate Buy consensus rating based on 12 Buys, eight Holds, and three Sell ratings. The average RIVN stock price target is $16.91, implying 96.9% upside potential.

The Takeaway: RIVN Stock Fails to Rise Off a Key Catalyst

With RIVN stock, it comes down to a simple narrative. Higher gas prices should boost Rivian because people are looking for good deals. The fact that RIVN is instead falling off the map implies that the net proposition for the EV manufacturer is negative. With that being the case, it looks like the valuation of the company needs to be adjusted downward, adding more pressure to this embattled organization.