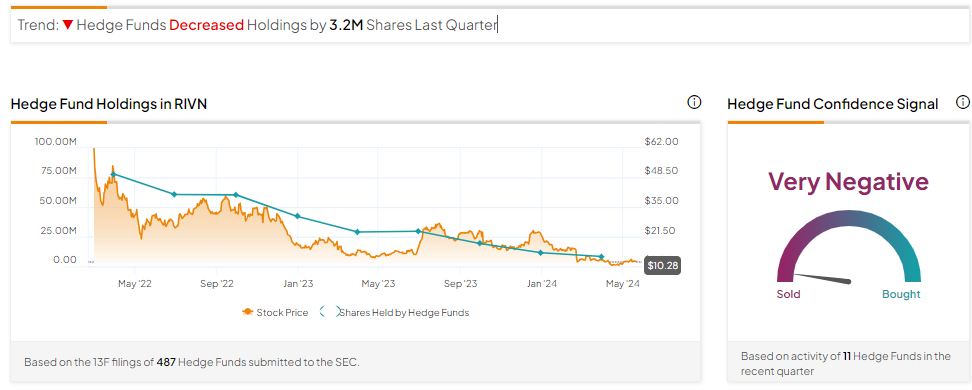

Hedge funds are popular for generating above-average returns, making it important for retail investors to monitor their stock transactions. Using TipRanks’ Hedge Fund Trading Activity tool (which analyzes data from Form 13-Fs to offer hedge fund signals), we found that these experts have turned their backs on Rivian Automotive (NASDAQ:RIVN) stock.

Rivian is a leading electric vehicle (EV) maker. RIVN stock has underperformed the broader market averages year-to-date.

Hedge Funds Sold RIVN Stock

It’s worth noting that the industry-wide weakness in EV demand amid high interest rates has weighed on EV stocks, including Rivian. Further, heightened price competition has pressured margins and dragged shares of the companies operating in the EV space lower.

Given the challenges, RIVN stock has declined by about 56% year-to-date.

The Hedge Fund Confidence Signal is Very Negative for RIVN stock based on the activity of 11 hedge funds. Hedge funds decreased their RIVN holdings by 3.2M shares in the last quarter. Coatue Management’s Philippe Laffont, Joho Capital’s Robert Karr, and two more hedge fund managers sold their holdings in RIVN stock.

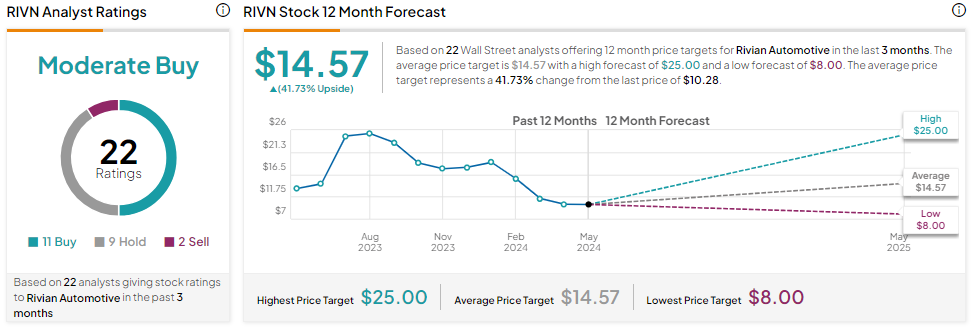

Is Rivian a Buy, Sell, or Hold?

Rivian stock has lost substantial value. However, softness in the EV market and competitive headwinds keep analysts cautiously optimistic. With 11 Buys, nine Holds, and two Sells, Rivian stock has a Moderate Buy consensus rating. Analysts’ average price target on RIVN stock is $14.57, implying 41.73% upside potential.

Bottom Line

While RIVN stock could face near-term pressure due to weak demand, the company’s production plant upgrade is expected to lower costs and enhance long-term profitability. Additionally, RIVN plans to reduce its gross inventory by over 25% in the coming months, improving its working capital. The company also reaffirmed its 2024 production target of 57,000 vehicles, which is a positive sign.

Though the stock has a Very Negative signal from hedge funds, Wall Street analysts remain somewhat optimistic about its prospects, and their price target suggests significant upside potential. This suggests that investors should consider multiple factors when making investment decisions. Investors can leverage TipRanks’ Experts Center tools to gather comprehensive insights to make informed investment decisions.