Shares in electric vehicle company Rivian Automotive (RIVN) reversed today after cutting delivery numbers for the rest of the year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Not So Normal

The company reported that it had built 10,720 vehicles and delivered 13,201 during the third quarter of the year from its Normal, Illinois factory.

The company said that the delivery results are in line with its outlook. However, it does mark a slowdown from the same period in 2024, when it produced 13,157 vehicles.

In another blow to investors, it said it was narrowing its 2025 delivery guidance to a range of 41,500 to 43,500 vehicles from the prior forecast range of 40,000 to 46,000 vehicles.

This added to investor concerns about competition in the electric vehicle market, waning customer interest as well as other regulatory and financial headwinds.

This includes the Trump administration’s rollback of U.S. emissions standards, which has reportedly cost Rivian approximately $100 million in lost revenue as the market for zero-emission vehicle (ZEV) credits has been significantly diminished.

Future Plans

U.S. regulators have also launched a preliminary investigation into potential seatbelt defects in more than 17,000 electric delivery vans.

The National Highway Traffic Safety Administration (NHTSA) is reviewing reports that a steel-braided cable, tied to the driver’s seat frame, can fray or break, potentially leaving occupants unrestrained in the event of a crash.

The company recently cut its workforce by less than 1.5% to streamline operations ahead of the launch of its more affordable R2 SUV, which it hopes will tempt drivers into the EV market.

It also broke ground on a new assembly plant about 45 miles east of Atlanta, which is expected to be Rivian’s second and is set to begin production in 2028.

Indeed, despite its troubles, the company’s share price is up nearly 17% in the last 6 months, which shows its EV journey may not be over yet.

Is RIVN a Good Stock to Buy Now?

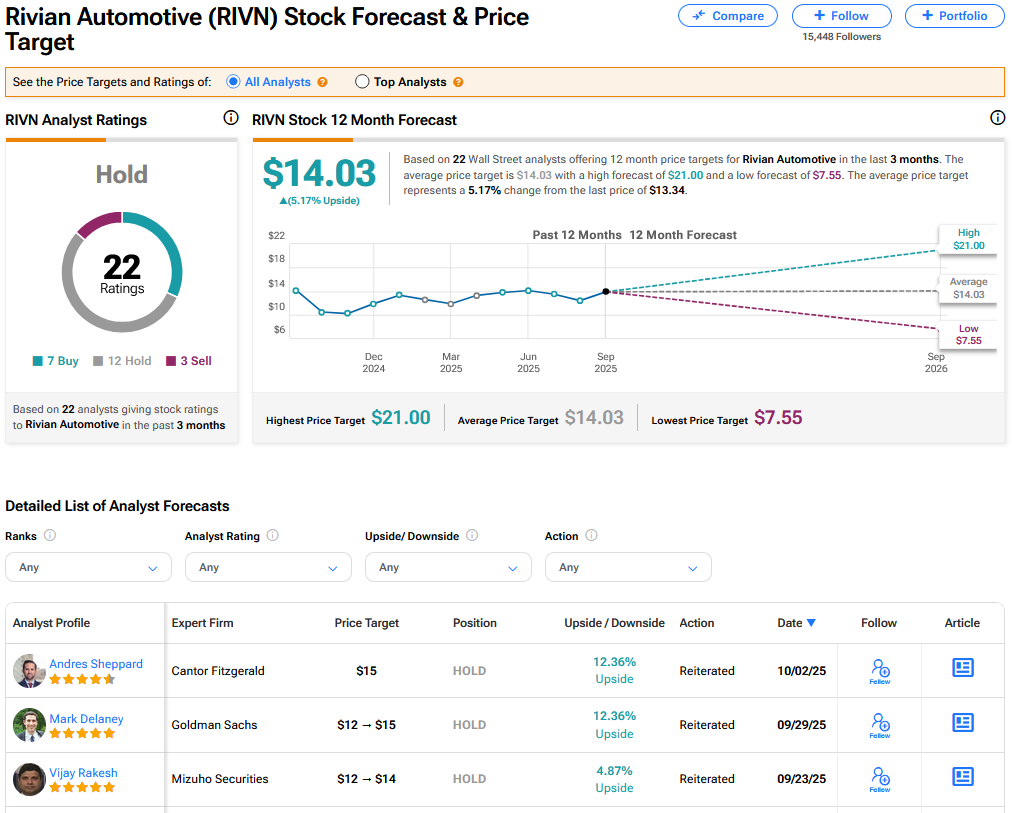

On TipRanks, RIVN has a Hold consensus based on 7 Buy, 12 Hold and 3 Sell ratings. Its highest price target is $21. RIVN stock’s consensus price target is $14.03, implying a 5.17% upside.