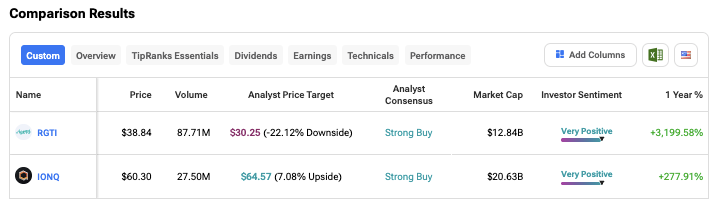

The quantum computing sector is in the spotlight, with investors excited about new technology breakthroughs driving growth. Amid this buzz, stocks like Rigetti Computing (RGTI) and IonQ (IONQ) have posted impressive gains. Over the last 12 months, RGTI stock has soared by over 3,000%, while IONQ has gained 277%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

RGTI vs. IONQ

Rigetti Computing makes superconducting quantum computers to power the next generation of technology. While an early leader in the field, its products are still in the early stages of commercial use. On the other hand, IonQ is a pure-play quantum computing company, developing trapped-ion quantum computers, a technology known for high accuracy.

Both companies are gaining from the growing excitement around quantum computing, but IonQ seems better positioned for the long run. It has secured more commercial partnerships and is making steady progress with its trapped-ion technology.

Most recently, quantum stocks surged after media reports stated that the U.S. government was considering taking equity stakes in these firms in exchange for federal funding. Notably, government funding usually goes to technologies that are ready for real-world use. IonQ already leads pure-play quantum companies in cloud access and enterprise adoption, meaning additional federal support could further strengthen its advantage.

However, the Trump administration later denied any plans to acquire stakes in quantum computing companies.

Is RGTI a Good Long-Term Investment?

Rigetti stands out in the quantum space by building all its hardware and software in-house. The company owns its fabrication facility, created its own programming language Quil, and offers a cloud platform for businesses to rent quantum computing power. By controlling the full supply chain, Rigetti can release updates faster than competitors. Its latest Cepheus-1-36Q is the largest multi-chip quantum computer in the industry, achieving 99.5% fidelity.

On the downside, Rigetti’s financial performance has been challenging. In Q2, revenues dropped 41.6% year-over-year, and the net loss was $39.7 million. Still, the company remains financially strong, holding $571.6 million in cash with no debt as of June 30, 2025.

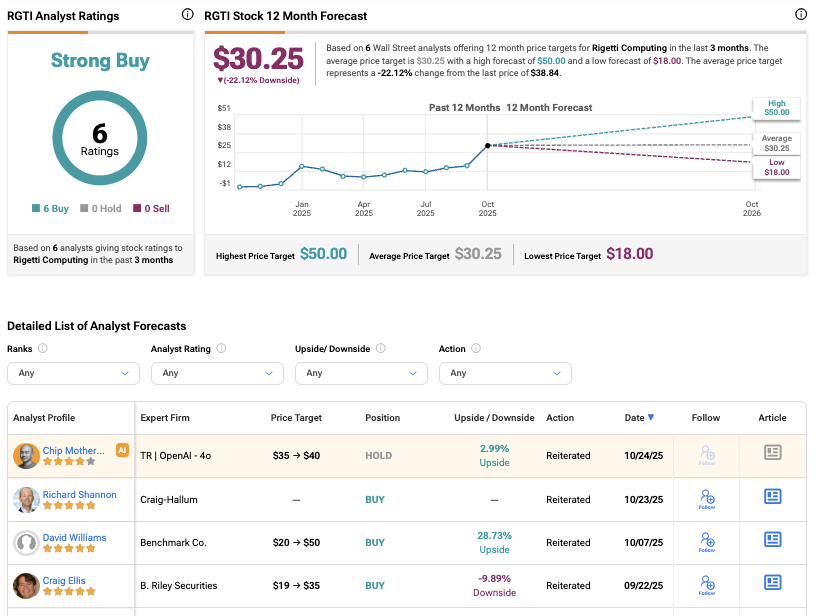

Rigetti Stock Price Forecast

On Wall Street, Benchmark’s five-star analyst David Williams is very bullish on RGTI stock, expecting it to rise more than 38% from current levels. Interestingly, among the six analysts tracked by TipRanks who cover the stock, Williams is the only one with a price target above the current price, even though all six have Buy ratings. He believes that as long as the quantum industry keeps making real technical and business progress, the sector should stay strong, even during wider market ups and downs.

Overall, Wall Street analysts have rated RGTI stock as a Strong Buy. Taken together, Rigetti’s stock forecast of $30.25 implies a downside of over 20% from the current level.

Is IonQ a Good Stock to Buy?

Recently, the company announced a major milestone, reaching 99.99% two-qubit fidelity. This marked the best performance reported in the quantum industry so far. This level of accuracy means fewer errors, allowing the systems to handle more complex tasks with fewer physical qubits.

Simply put, higher fidelity helps IonQ move faster toward practical, scalable quantum computing. The company says this breakthrough will support its next-generation 256-qubit machines expected in 2026. Unlike earlier laser-controlled systems, the new machines use electronic control, enabling them to be built with standard chip-making processes. That could lead to easier manufacturing, better stability, and lower costs as IonQ scales up.

For investors, the message is clear: IonQ is not only innovating but also gaining ground quickly in the race for quantum dominance.

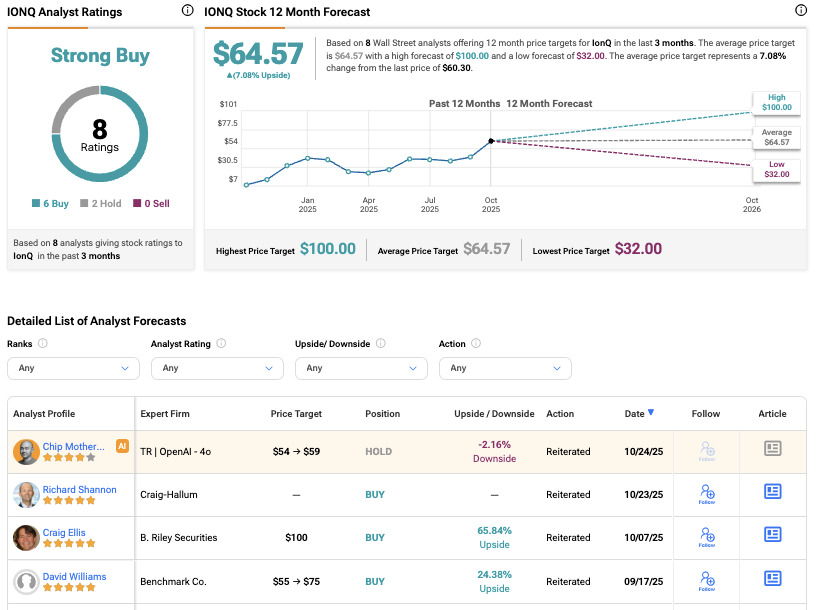

What Is the Price Target for IONQ?

Unlike RGTI, IONQ has bullish price targets from multiple analysts. Earlier this month, five-star B. Riley Securities analyst Craig Ellis reiterated his Buy rating on the stock, forecasting more than 60% upside from current levels. Ellis highlighted that IonQ is leading the industry in revenue growth, delivering three consecutive years of 100% year-over-year gains. He also believes the company is on track to exceed $1 billion in revenue by 2030.

Overall, IONQ stock has a Strong Buy consensus rating based on six Buys and two Holds assigned over the last three months. Meanwhile, the average IonQ share price target of $64.57 suggests a 7.08% upside from current levels.

Conclusion

While both IonQ and Rigetti are riding the momentum of the quantum computing boom, IonQ appears to have a stronger edge for long-term investors. The company has expanded commercial partnerships faster and continues to scale its trapped-ion technology more efficiently.

However, both remain high-risk, early-stage plays with long timelines to profitability. For long-term investors willing to take some risk, it may still be a good time to gain exposure, even if recent rallies could cool in the near term.