IonQ (IONQ) announced it has reached 99.99% two-qubit gate fidelity, a measure of how accurately its quantum systems perform operations. The result, achieved with its Electronic Qubit Control, or EQC technology, marks the highest level of performance ever reported in the field. It also surpasses the 99.97% record set in 2024 by Oxford Ionics, which IonQ acquired last year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In simpler terms, higher fidelity means fewer errors and more reliable results. As IonQ raises accuracy, its machines can run more complex calculations and require fewer physical qubits to reach useful performance. This also lowers the time and cost needed to build and scale larger systems.

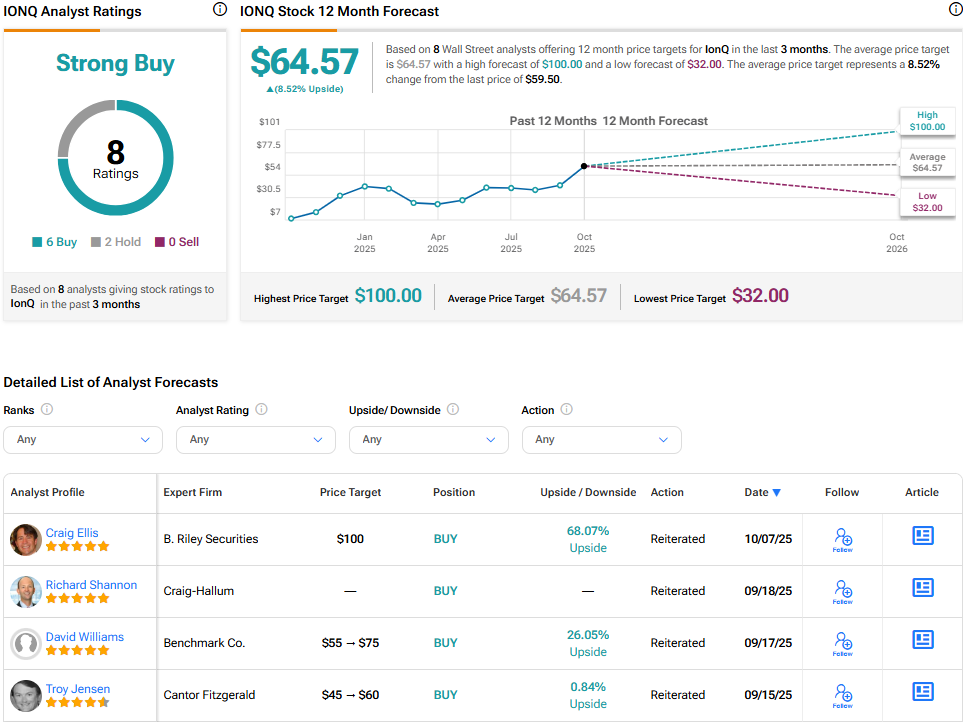

Meanwhile, IONQ shares declined 0.73% on Tuesday, closing at $59.50.

Path to Larger Systems

IonQ said the new technology will support its next-generation of 256-qubit systems planned for 2026. These systems use electronics rather than lasers to control qubits, which allows the company to produce its machines through standard semiconductor manufacturing. The move could make the hardware easier to scale, more stable to operate, and less costly to build.

The company believes this step brings it closer to fault-tolerant quantum computing, where machines can run long calculations without frequent correction. IonQ said its results could lead to a ten-billion-times increase in effective performance compared with systems that operate at 99.9% fidelity.

Industry Context

IonQ competes with firms such as International Business Machines (IBM), Quantinuum, and Rigetti Computing (RGTI). Its focus on trapped-ion qubits and electronic control differs from rivals that rely on superconducting or photonic designs.

The company said its progress could shorten development time for commercial quantum products. IonQ has already worked on projects involving drug discovery, computer-aided engineering, and AI. As it continues to improve performance, IonQ aims to scale toward millions of qubits by 2030.

Is IonQ Stock a Buy?

On the Street, IonQ holds a Strong Buy consensus, based on eight analysts’ ratings. The average price target stands at $64.57, implying an 8.52% upside from the current price.