The name DouYo (NASDAQ:DOYU) may not strike any bells, but this Chinese stock is a pretty big name in the game streaming service market. That already probably makes its founder, Shaojie Chen, a bit suspicious to Chinese authorities, who were seen banning games entirely from the country not so long ago. But now, Chen has been missing for quite some time, and reports note the Chinese authorities were the ones who took him away. Investors are less than concerned, meanwhile, as the stock is only down fractionally in Tuesday afternoon’s trading.

DouYu has the backing of nothing less than Tencent (OTHEROTC:TCEHY), which makes Chen’s disappearance somewhat more notable. But apparently, the Chinese authorities have had him for quite some time, noted reports, and for some surprising reasons. Apparently, the fact that DouYo is a gaming host didn’t matter so much. Rather, the word about there being active gambling and pornography available through DouYu was something of a different matter. The reports of that, in turn, prompted the Chinese government to send out officials from its internet watchdog operation to engage in a period of “…intensive rectification and supervision” on the platform that lasted a month.

We’ve seen similar matters happen before—remember when Alibaba’s (NYSE:BABA) Jack Ma got under the Chinese government’s scrutiny?—but perhaps not to this much of an extent. But this might be one—or rather one more—reason why many firms are pursuing a policy known as “friendshoring,” departing one region whose government is unfriendly toward businesses in favor of other countries without so many restrictions.

Is DouYu a Buy or Sell?

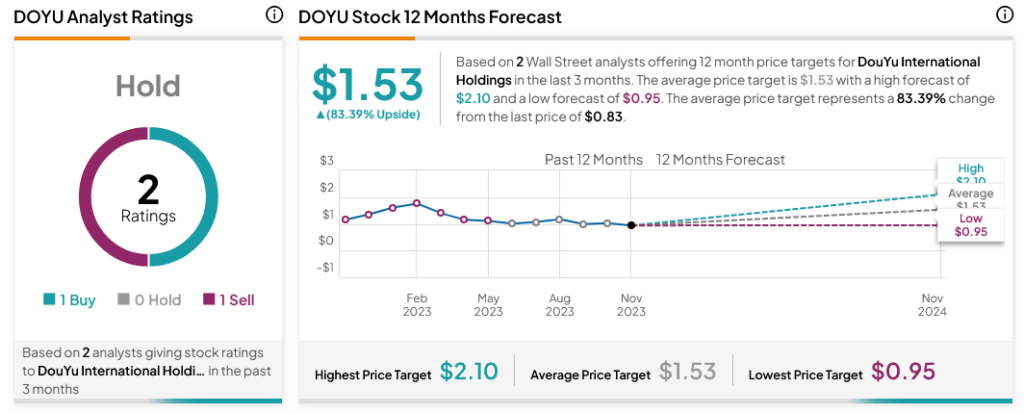

Turning to Wall Street, analysts have a Hold consensus rating on DOYU stock based on one Buy and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average DOYU price target of $1.53 per share implies 83.39% upside potential.