Regions Financial (NYSE:RF) shares are in focus today after the company delivered a better-than-anticipated performance for the fourth quarter. Indeed, EPS of $0.52 exceeded estimates by $0.06. Additionally, revenue of $1.81 billion fared better than expectations by $10 million despite witnessing a 9.5% year-over-year decline.

For the full year, revenue rose by 5% to a record $7.6 billion. Net income available to common shareholders for the year stood at $2 billion. For the fourth quarter, net income available to common shareholders came in at $367 million.

In Q4, net interest income trended lower to $1,231 million from $1,291 million in the prior quarter due to higher deposit and funding costs. In sync, RF’s net interest margin dropped to 3.6% from 3.73%. In contrast, noninterest income increased to $580 million from $566 million in the prior quarter on the back of modest gains across multiple categories.

At the same time, RF’s noninterest expense increased by 8%. This included $28 million in severance charges and $119 million in costs stemming from the special FDIC assessment. On an adjusted basis, the company’s noninterest expense declined by 5% sequentially. Further, its efficiency ratio for the quarter stood at 65%.

Is RF Stock a Good Buy?

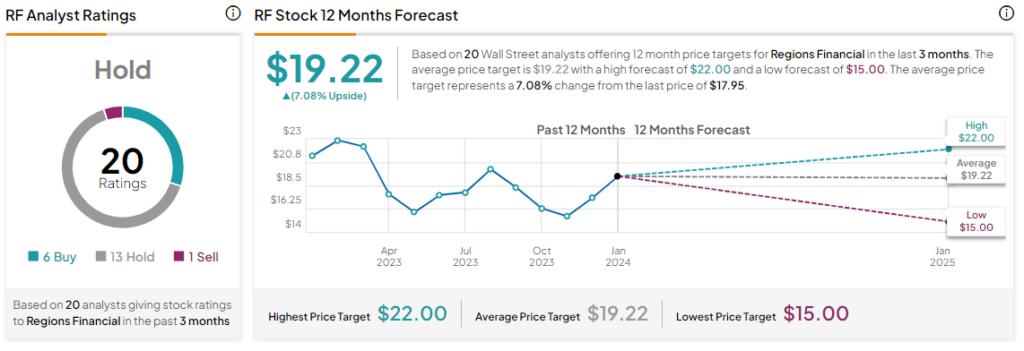

Overall, the Street has a Hold consensus rating on Regions Financial. Following a nearly 18% decline in the company’s share price over the past year, the average RF price target of $19.22 points to a modest 7.08% potential upside in the stock.

Read full Disclosure