QuantumScape (QS) stock is under pressure ahead of its Q3 earnings report, due after the market closes today, having declined over 13% during Wednesday’s trading session. The analysts forecast a loss of $0.20, lower than the loss of $0.23 in last year’s quarter. Ahead of the earnings report, technical indicators suggest that QS stock is a Buy on a one-day timeframe, which implies upside potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analyzing QS Stock’s Technical Indicators

According to TipRanks’ easy-to-understand technical analysis tool, QuantumScape stock is currently on an upward trend. The Moving Average Convergence Divergence (MACD) indicator, which helps understand momentum and potential price changes, signals a Buy.

Further, the stock’s 50-day Exponential Moving Average (EMA) is 12.49, while its price is $13.41, implying a bullish signal. Also, its shorter-duration EMA (20 days) signals a Buy.

Moreover, the Rate of Change (ROC) is a momentum-based technical indicator. It measures the percentage change in a stock’s price between the current price and the price from a specific number of periods ago. Typically, a ROC above zero confirms an uptrend. QS stock currently has an ROC of 6.37, which signals a Buy.

Another technical indicator, Williams %R, helps traders see if a stock is overbought or oversold. For QuantumScape, Williams %R currently shows a Buy signal, suggesting the stock is not overbought and has room to run.

Is QS Stock a Good Buy?

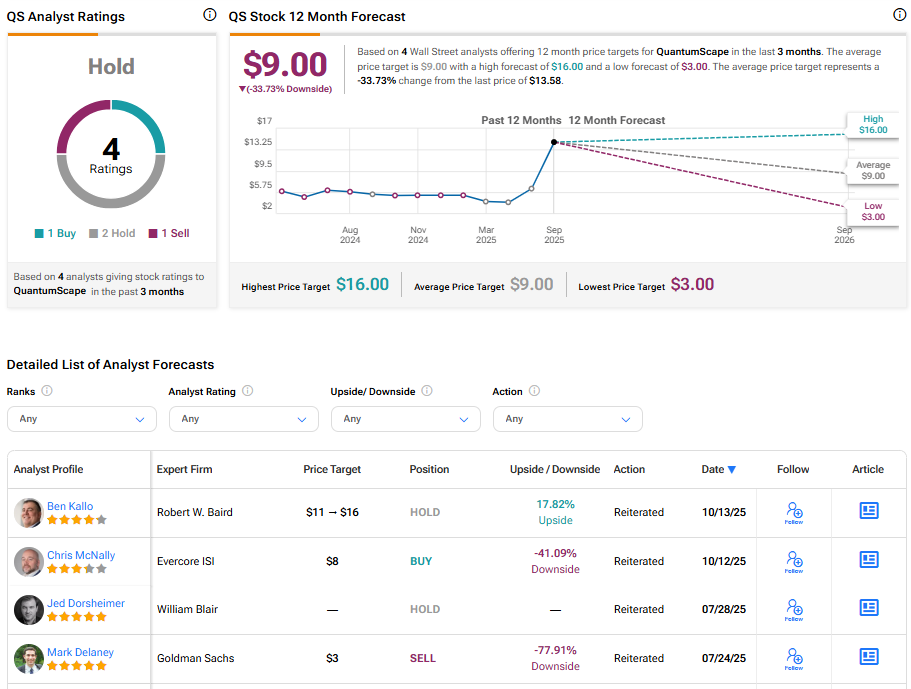

Turning to Wall Street, analysts have a Hold consensus rating on QuantumScape stock based on one Buy, two Holds, and one Sell assigned in the past three months. At $9.00, the average QS stock price target implies a 33.73% downside risk.